Understanding EIP-3074 and Its Benefits

A deep dive into EIP-3074, an Ethereum proposal that enables sponsored transactions

Youtube Video

Playing the video that you've selected below in an iframe

Understand the growth potential and risks factors associated with digital asset market.

The Web3 space has seen remarkable growth over the years, fundamentally reimagining how people transact, interact, and collect assets. Central to this digital emergence are various forms of blockchain-based digital assets. Cryptocurrencies have revolutionized the concept of digital currency, while Non-Fungible Tokens (NFTs) are transforming digital collectibles. Additionally, the development of smart contracts, giving rise to Decentralized Finance (DeFi) and stablecoins, highlights the versatility of blockchain applications.

Yet, this surfacing digital asset landscape is not without hazards. As the value and popularity of these assets rise, they become increasingly attractive targets for cybercriminals. The sector has witnessed numerous high-profile security breaches, leading to significant financial losses and highlighting the vulnerabilities inherent in digital assets. With such vast sums involved, the security of digital assets is a critical concern.

This blog will explore the current state of the digital asset market, its growth trajectory, and the risks that accompany it. We will also discuss the emerging solution of parametric coverage, which stands out as a promising approach to protecting funds and digital assets in this rapidly evolving domain.

The cryptocurrency market continues to be a dynamic and volatile sector, with Bitcoin and Ethereum maintaining their dominance. The rise of various DeFi projects and tokens has diversified the landscape, offering investors a wider array of options. Moreover, the DeFi sector is continuously offering decentralized, transparent, and accessible financial operations by leveraging blockchain technology.

Similarly, the NFT market, initially centered on digital art, has expanded into new domains such as Metaverse, virtual real estate, entertainment, sports, and gaming.

The tokenization of real-world assets is another exciting development, creating digital tokens that represent ownership or a stake in physical assets. Additionally, decentralized identity solutions in Web3 are emerging, focusing on giving users more control over their digital identities.

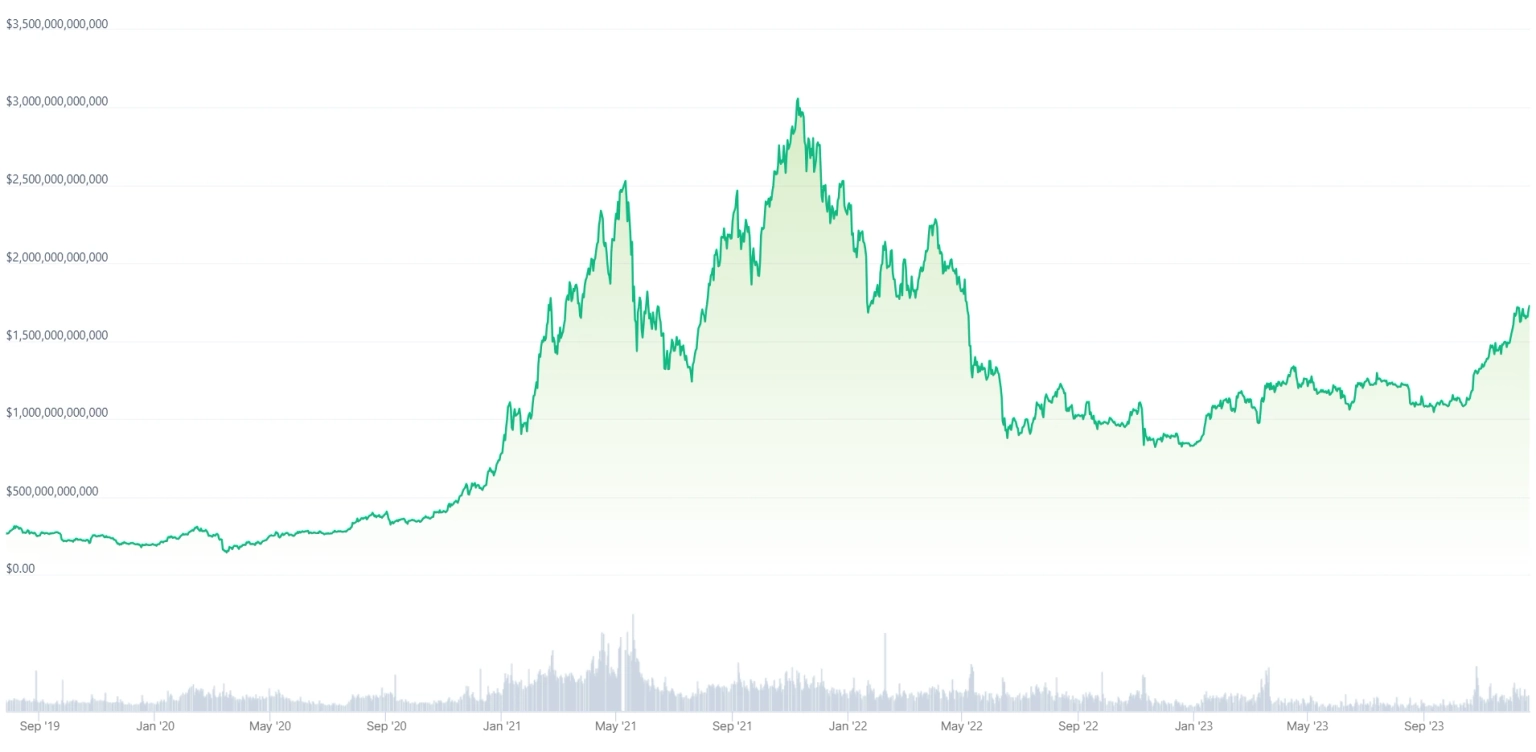

The evident growth of the blockchain space can be clearly depicted with the recent data. According to CoinGecko, the cryptocurrency market is currently worth over $1.6 trillion as of December 22, 2023.

As you can see from the graph above, it was around $3 trillion at some point in the past. And with the increasing developments and adoption of Web3, there's an anticipation of this market experiencing further growth, potentially surpassing previous highs.

The growth of the digital asset market is driven by several key factors. Technological advancements in blockchain, smart contracts, and scalability solutions are at the forefront of this growth.

Blockchain technology has already shown its utility in several industries, such as finance, healthcare, security, media, data sharing, governance, law, and many other real-world use cases. Financial organizations like PayPal, Visa, and Mastercard have ventured into the Web3 world, whereas tech heavyweights such as Tesla and MicroStrategy have made decisive moves by incorporating cryptos like Dogecoin and Bitcoin into their financial reserves. Such steps by prominent companies are pivotal in lending cryptocurrencies a newfound level of legitimacy and stability.

Furthermore, some governments have embraced digital assets, implementing regulations that encourage the usage of crypto and digital assets. For example, Colorado has started accepting residents’ taxes paid in crypto since September 2022. Another prime example is El Salvador, which has declared Bitcoin as a legally recognized second national currency. Such development of regulatory frameworks across various countries could offer a clearer operating environment for digital assets.

The inherent decentralized nature of blockchain itself is fueling the market's expansion. They offer a low barrier to entry, making it possible for anyone with an internet connection to engage in the digital asset space. It bypasses traditional financial requirements such as personal identity verification and KYC procedures and lets users retain control over their funds without the need to entrust them to centralized financial institutions.

The digital asset space, while presenting vast opportunities, is increasingly becoming a hotspot for sophisticated cyber threats. As the sector attracts more funds, it also draws the attention of attackers keen on exploiting its vulnerabilities.

Smart contract vulnerabilities are a major concern that has accounted for the loss of millions of dollars. Similarly, flash loan attacks, phishing, Sybil attacks, front-running attacks, etc. are some other ways hackers steal your digital assets. We have a detailed article on the main DeFi security risks that you might want to check out.

To illustrate the severity and sophistication of these threats, let's examine some notable examples where such attacks have led to significant financial losses. The Kyber Network suffered a loss of $48.3 million due to a smart contract vulnerability. This attack was noted for its complexity and precision in exploiting the smart contract's logic. Another major incident involved the HECO Bridge and HTX, where compromised operator accounts led to a staggering loss of $99.3 million.

These are just a few examples among a growing list of incidents, with new breaches and exploits occurring almost daily. You might be shocked to know that around $3.8 billion was lost in 2022 alone due to crypto hacking.

You can find the details of the previous crypto exploits in our hack database. For a complete exploration, you can find detailed exploit analysis of the recent incidents on our blog page as well.

So, what can we collect from those incidents?

Projects within this space are tirelessly working to fortify their defenses. A key strategy is the rigorous auditing of smart contracts, a critical checkpoint to identify and rectify vulnerabilities. Regular security updates and bug bounty programs further reinforce this protective shield.

Additionally, the adoption of new technologies such as multisig (multi-signature) wallets, advanced consensus rules, and hardware security modules enhances the overall security infrastructure. Despite these efforts, attackers continually evolve their tactics, finding novel ways to breach security protocols.

Perhaps, it's time for digital asset owners to explore additional security strategies to address these vulnerabilities and risk factors. Let us inform you about DeFi insurance.

As the digital asset market matures, the integration of financial protection mechanisms, such as on-chain cover, is becoming increasingly vital. These innovative products are tailored to the unique nature of blockchain and DeFi, offering protection against the specific risks inherent in this space.

Simply put, a digital asset owner can mitigate the risks of losing those assets by acquiring coverage through DeFi insurance protocols. In the event of hacks or exploits, the policyholders receive payouts from the cover providers.

The parametric model of coverage, which is designed to operate on predefined parameters, is efficient in terms of incident resolution and payouts.

Unlike discretionary insurance, on-chain parametric coverage doesn’t rely on detailed claims evaluation processes. When a set of predefined conditions, like certain types of smart contract failures or security breaches, are met, policyholders would be eligible for payouts. We have created a comprehensive blog post to help you understand the differences between parametric and discretionary coverage in DeFi.

This approach streamlines the claims process, offering a more efficient and transparent solution for risk management. The effectiveness of these tools is evident in their growing adoption, providing a safety net that enhances user confidence and encourages broader participation in the blockchain ecosystem.

Neptune Mutual is a pioneer of parametric coverage in the decentralized finance (DeFi) insurance landscape on the Ethereum network. At Neptune Mutual, we offer a unique cover marketplace, enabling projects to create cover pools. Users who have their funds invested in the projects can purchase coverage from the cover pools.

Neptune Mutual, being a parametric cover solution, is built around the concept of predefined cover parameters. The cover parameters are easily viewable for everyone, so every cover purchaser would have an idea of the conditions that result in payout.

In the event of an incident affecting the project that activates the parameters, the policyholders become eligible for the claims. We ensure swift and direct stablecoin compensation, streamlining the process without the need for personal information, proof of loss, or delayed judgments.

While we primarily focus on the Ethereum network, our services are not limited to it. The platform also supports additional networks like Arbitrum and BNB Smart Chain, catering to a diverse range of users across various blockchain ecosystems. This multi-chain capability empowers users to safeguard their investments in DeFi, CeFi, and Metaverse applications, providing a robust and versatile insurance solution.

Neptune Mutual is more than just an insurance provider. It encompasses various features that benefit different participants in the Neptunite ecosystem, including policy purchasers, liquidity providers, and NPM token holders.

Additionally, here are some other offerings from Neptune Mutual:

Moreover, we are gearing up to introduce new features that will further benefit the Neptunite community.

For blockchain project owners seeking to safeguard their protocols and communities, Neptune Mutual presents an ideal platform to create cover pools. Interested projects can reach out through the contact page for further discussions.