Understanding EIP-3074 and Its Benefits

A deep dive into EIP-3074, an Ethereum proposal that enables sponsored transactions

Youtube Video

Playing the video that you've selected below in an iframe

This blog post explains everything about PYUSD, the stablecoin introduced by PayPal.

PayPal and stablecoins are not terms you'd expect to hear together, until now. PayPal is a centralized company and could arguably be described as TradFi. However, PayPal has been involved in the crypto and blockchain markets for some time now.

The goal of many DeFi purists is to see people move away from fiat and rely on their cryptocurrency of choice for daily transactions, but that's just one view of how a crypto/Web3-centric world would work. There are others who welcome PayPal with open arms, as their numerous ventures into the crypto ecosystem are viewed as "healthy adoption".

On August 7th, 2023, PayPal announced the launch of its native stablecoin, PayPal USD (PYUSD), becoming the first major U.S.-based financial company to do so.

Today, we’re unveiling a new stablecoin, PayPal USD (PYUSD). It’s designed for payments and is backed by highly liquid and secure assets. Starting today and rolling out in the next few weeks, you’ll be able to buy, sell, hold and transfer PYUSD. Learn more https://t.co/53RRBhmNHx pic.twitter.com/53ur2KmjU7

— PayPal (@PayPal) August 7, 2023

In this blog post, we’ll delve into the PayPal stablecoin, including its features and benefits, and how it could be a catalyst for mainstream adoption of crypto. Let’s start by mentioning several forays of PayPal into Web3.

PayPal has been associated with blockchain and crypto for a long time. Back in 2013, David Marcus, the company's president at the time, expressed an interest in adding bitcoin as a funding mechanism on PayPal. In 2014, they released a promo video that talked about sending Bitcoin, but that video was quickly replaced with another one without cryptocurrency references.

They experimented with various methods of allowing merchants to accept cryptocurrency payments and looked at other ways of making use of digital payments, including expressing an interest in Libra. It wasn't until 2020 that they added the option for consumers to buy cryptocurrencies in-app and have those currencies automatically converted into fiat to be spent at any merchant that accepted PayPal as a payment method.

Their interest goes beyond simple "buy and spend". They understand that using cryptocurrencies is difficult for some less-technical individuals, and they're investing in ways to make the experience easier. PayPal has even integrated with MetaMask to help users purchase Ethereum and transact with it seamlessly.

PayPal USD (PYUSD) is a U.S. dollar-pegged stablecoin on the Ethereum blockchain, launched by PayPal and issued by Paxos Trust Company. It’s redeemable 1:1 for U.S. dollars, meaning users can convert one PYUSD to one U.S. dollar and vice versa.

With the launch of PYUSD, PayPal aims to create a bridge to facilitate a seamless transition between fiat and digital currencies.

With the launch of PYUSD, users can transfer PYUSD between PayPal accounts and external Ethereum wallets that support PYUSD. People can also use the token during checkouts during shopping, as PayPal sells your PYUSD to pay for the items. Not only that, but buying several other supported currencies with PYUSD is also possible.

Although PYUSD is still a relatively new stablecoin, it has the potential to become one of the most trusted ones. Like any other stablecoin, it offers a way to store funds, shielding them from market volatility. In addition, the fact that it's developed by PayPal and issued by Paxos Trust Company increases the legitimacy and credibility of PYUSD.

PYUSD is not the first stablecoin on the market, but it has several features that may make it appeal to more cautious cryptocurrency traders.

Firstly, it's 100% backed by USD deposits. There are some other stablecoins claiming to be backed fully by assets or currencies, but that’s not always the case. For instance, Binance had several allegations about not backing BUSD properly before its issuer, Paxos, was ordered to stop BUSD’s support.

As a company with a long history in financial services, PayPal's claims of backing may carry more credibility, which could make it more trustworthy.

PayPal is uniquely positioned to bridge the gap between TradFi and DeFi. As a household name, it has the opportunity to introduce those who may not be aware of the benefits of Web3 to the space, building mainstream adoption. It can also use its expertise in the TradFi world to potentially bring stability to DeFi, something that is still desperately needed after events such as the collapse of LUNA.

PYUSD is built on Ethereum, making it easy for users to swap, transact, or hold it with their existing wallets. It's accessible through the PayPal platform, which most people are likely to already have an account with for day-to-day fiat transactions and online shopping.

The stablecoin is issued by Paxos Trust Company, a company with plenty of expertise in the DeFi world as a cryptocurrency issuer. Paxos operates under the supervision of the U.S. Department of Financial Services (DFS), so this could potentially make PYUSD users confident about their funds’ safety and management.

Unfortunately, just as white-hat developers can find ways to interface with the PYUSD token on the blockchain, there are scammers who are looking to take advantage of users. No sooner than PayPal announced the launch of PYUSD, there was a rush of fake PYUSD tokens for swaps on Uniswap and other decentralized protocols.

These fake tokens have similar tickers and have launched on BSC, Base, Ethereum, and other chains. Those who are looking for the real PYUSD must ensure they're interacting with the official Paxos PYUSD smart contract address:

0x6c3ea9036406852006290770BEdFcAbA0e23A0e8

Other tokens are simply imposters.

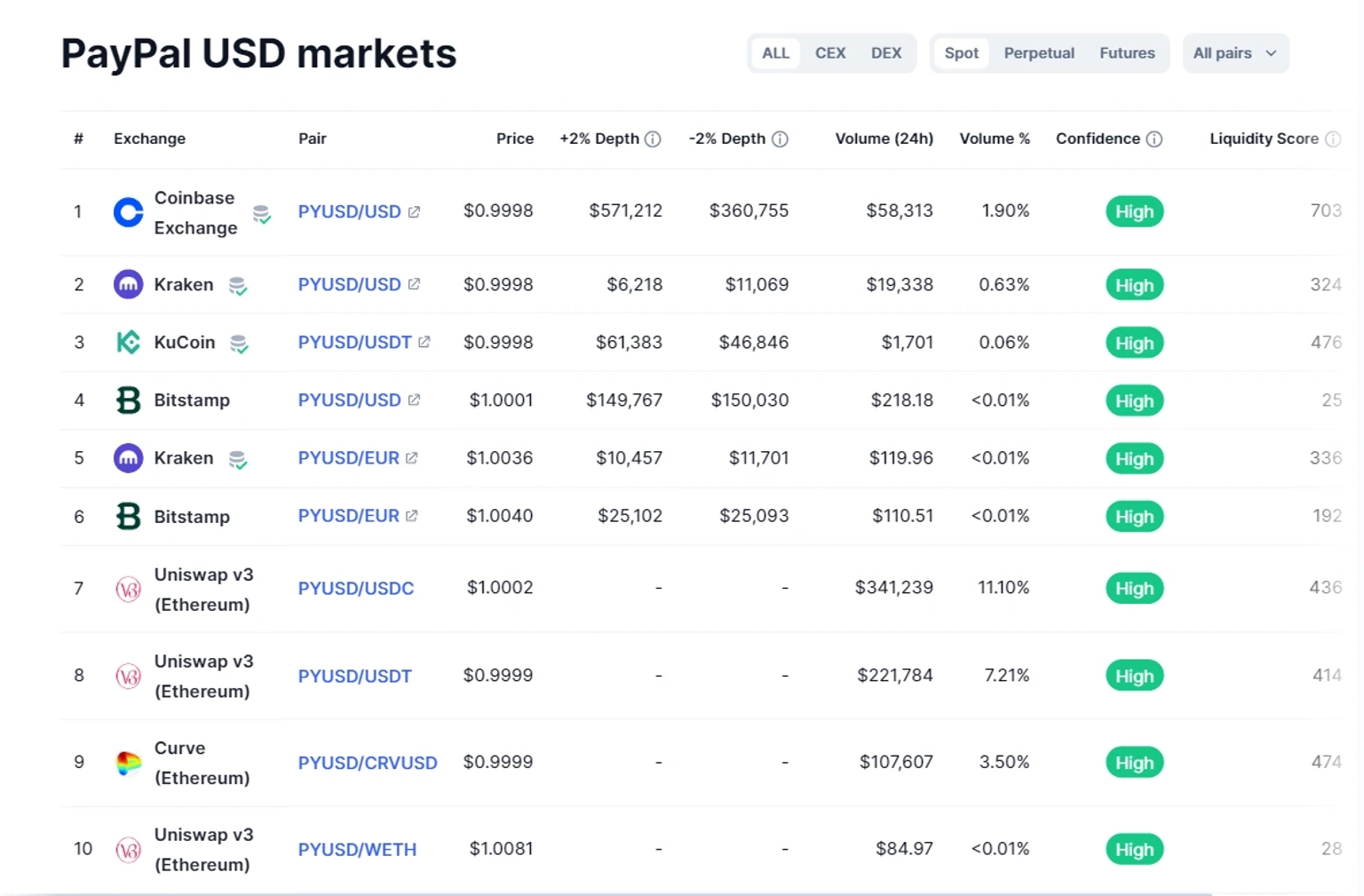

PYUSD is officially only available to PayPal US customers. However, since it's an ERC-20 token and PayPal allows people to withdraw and transact using the token, it started trading on many other exchanges and DeFi platforms.

It's important to emphasize the significance of PayPal's stablecoin launch. The platform has around 453 million users worldwide. While not all those users will immediately have access to PYUSD, the goal is to roll out wider access, introducing cryptocurrencies to people in an accessible and less intimidating way.

Getting users accustomed to stablecoins or cryptocurrencies as a convenient way of handling transactions means they could explore and experiment in other areas of Web3 too. On the other hand, PayPal users who’re used to transacting with crypto can now no longer have to switch to other platforms with the release of its own stablecoin.

PayPal is the first of many Web2 companies that are willing to innovate and make the leap to Web3.

Similarly, we’ve seen more Web2 giants like Visa and Mastercard adopting Web3 in their ecosystems and Mastercard partnering with the Aptos chain. Users who are initially hesitant to embrace Web3 will likely start to participate as more brands demonstrate their confidence and commitment to this new digital landscape.

As a company focused on financial services in Web3, Neptune Mutual is thrilled to see Web2 companies venturing into Web3.

We have a cover marketplace offering parametric insurance coverage for users, which means faster payouts in case of incidents. Our cover marketplace offers cover policies for many protocols and is available on Ethereum, Arbitrum, and BNB Smart Chain.

If you have a Web3 project and you want to protect it and your community, reach out to us. We can help you create a cover pool for your protocol in our marketplace.

If you want to know more about us, follow us on X (Twitter) and join our Discord.