Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

Explore Neptune Mutual's cover pools, and their benefits for cover creators and LPs.

Traditional insurance operates on a simple model, pooling policy fees to reimburse policyholders in the event of a claim. However, DeFi introduces a distinct approach to this model. For this example, let’s take a look at our DeFi insurance protocol: Neptune Mutual.

Here, rather than a centralized pool of policy fees, projects establish their own liquidity pools. These pools enable the community to purchase cover policies, backed by stablecoin liquidity contributed by liquidity providers. In return, these providers gain the potential for attractive financial returns and rewards.

The amount of liquidity available directly influences the number of cover purchases that can be supported. Therefore, increasing liquidity enhances the risk underwriting capacity of the project.

Neptune Mutual offers two primary types of cover pools: Diversified and Dedicated. Each type is tailored to meet the distinct needs of liquidity providers (LPs) and cover creators, optimizing benefits for all parties involved.

This blog aims to provide a fresh perspective on the different types of liquidity pools available at Neptune Mutual and their specific implications. Let's dive into the details.

Let’s go on to the details of both types of cover pools.

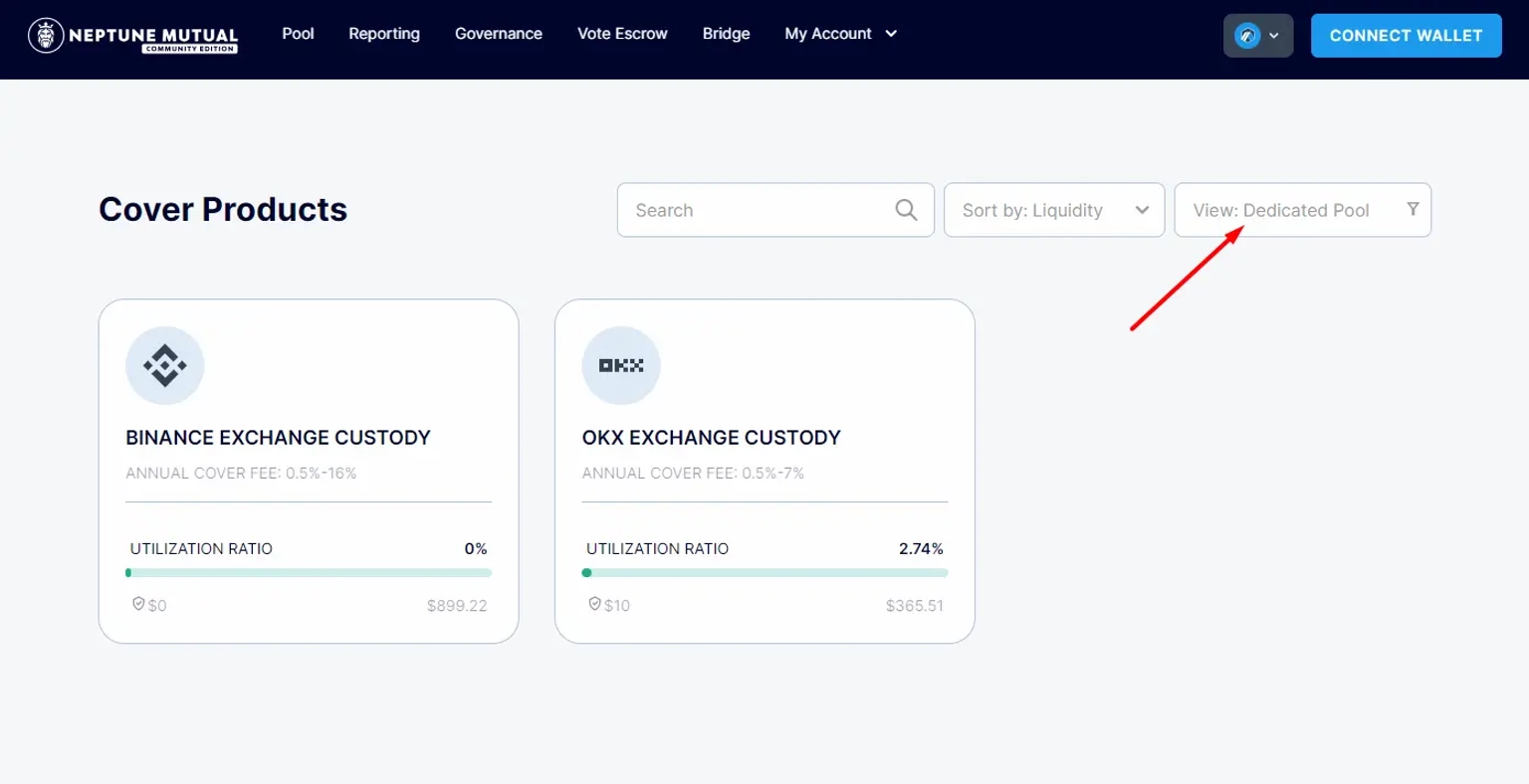

Dedicated cover pools at Neptune Mutual are specialized liquidity pools created by product owners or developers for a singular, standalone product. These pools are particularly designed with cover parameters that directly address the unique security risks relevant to their specific project community.

It is beneficial for DeFi or Metaverse projects that have an established community, the members of which are the primary beneficiaries of these customized cover policies.

In a Dedicated cover pool, liquidity providers contribute their assets solely to this individual pool. So, the funds are used explicitly to cover the risks associated with that specific project. This singular allocation also allows pool owners to seek liquidity support from their trusted community members or investors, enhancing the pool's robustness and capacity.

The returns on the liquidity provided to a Dedicated pool are entirely dependent on the fees collected from the cover policy purchases.

A significant advantage of Dedicated cover pools is the assurance of cover payouts. These pools are specifically allocated to cover a single project, they maintain a liquidity level that exceeds the maximum coverage underwritten. This structure provides a 100% guarantee of payouts to cover purchasers, ensuring that claims can always be met.

Neptune Mutual’s marketplace provides easy navigation for users interested in exploring or participating in Dedicated cover pools as cover purchasers or liquidity providers. You can simply select "Dedicated" from the drop-down menu to view available dedicated pools on each network.

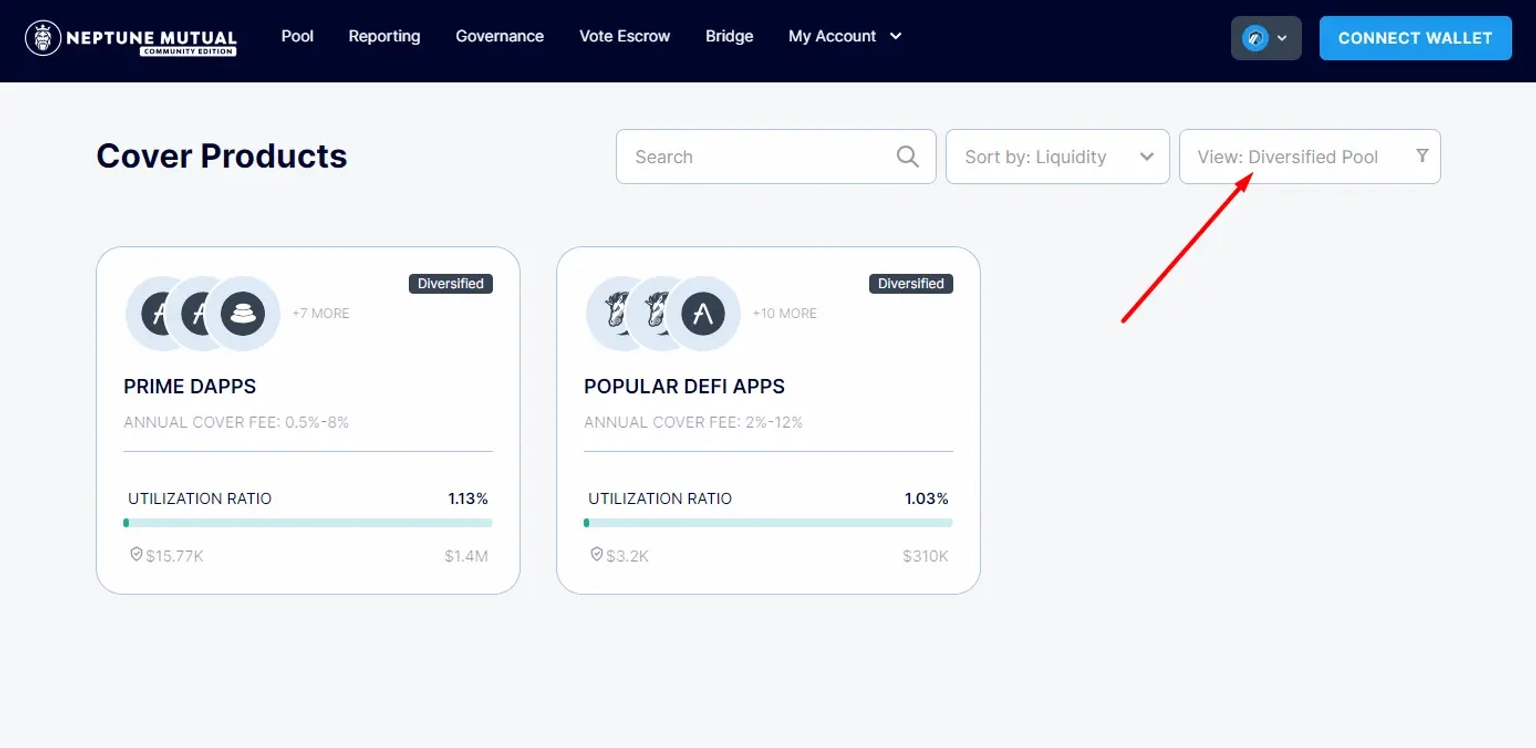

In contrast to Dedicated cover pools, Neptune Mutual also offers Diversified cover pools, which consist of a variety of cover products under a single portfolio. These pools are formed with the collaboration of multiple teams or product owners collaborating and pooling liquidity collectively.

In a Diversified cover pool, liquidity providers (LPs) do not allocate their resources to any single cover product. Instead, their contributions are spread across all the cover products included in that pool.

This distribution of funds ensures that liquidity impacts a broader range of projects, enhancing the overall stability of the pool. Returns for LPs in this model are derived from a collective share of the cover fees generated by all the cover products within the pool.

Each cover product within a diversified pool is governed by its own specific parameters, which trigger the cover policies when certain conditions are met. It's important for cover purchasers to understand that cover policies can only be bought through a specific project pool and cannot be bought directly from the diversified cover pool. This ensures that while the liquidity is pooled for enhanced capacity, the cover purchases remain targeted and specific to individual project needs.

Moreover, Diversified cover pools offer a notable advantage to liquidity providers. LPs can expect higher returns provided there's a significant policy purchase in the pool. The diverse range of cover products within the pool makes it highly unlikely that all will become claimable simultaneously, allowing for higher potential returns on pooled funds.

To explore the Diversified cover pools on the Neptune Mutual marketplace, you can choose "Diversified" from the drop-down menu in all networks.

If you look at Prime Dapps Diversified cover pool, for example, you’ll see individual cover products like AAVE, Balancer, Curve Finance, Maker DAO, SAFE, Synthetix, and Uniswap.

At Neptune Mutual, the scope for creating cover extends beyond individual product developers and owners establishing Dedicated or Diversified cover pools. We also empower organizations and agencies operating within the Web3 space to create cover pools to cater to the needs of their clients.

This is especially advantageous for agencies with a portfolio of multiple projects, as they can establish diversified cover pools to secure the communities of their client projects. Each project under such an agency can have its own individual cover pool, from which its users can purchase cover policies.

If you're a Web3 project and are considering setting up a cover pool, you can work collaboratively with Neptune Mutual. We can discuss and determine the essential aspects such as trigger parameters, required liquidity, cover fees, and the returns on liquidity provided.

Additionally, Neptune Mutual offers an SDK that allows other protocols to seamlessly integrate and offer Neptune Mutual cover policies directly through their applications. This integration facilitates project owners in providing their users with an easy and quick way to purchase cover policies directly from their own platforms.

Furthermore, any seller can integrate Neptune Mutual’s SDK into their platform, not just product owners. A seller who integrates our SDK and sells cover policies becomes eligible to earn a commission on sales, as per the terms agreed with Neptune Mutual.

Let’s see the benefits of Neptune Mutual cover pools for LPs and cover creators.

Investing in Neptune Mutual cover pools offers liquidity providers (LPs) several compelling benefits. Firstly, LPs enjoy high returns from their liquidity contributions. These returns are generated from the cover policy fees collected on cover purchases within the pool they contribute to.

Notably, the recent surge in cover purchases, especially on the BNB Smart Chain network, has yielded returns exceeding 12% for LPs, underlining the robust demand for more liquidity in our pools.

Another major advantage of Neptune Mutual’s system is the absence of indefinite lock-ins, which often deter participation in liquidity pools. Our protocol is designed with a maximum coverage period of three months, ensuring that LPs are not bound indefinitely. Moreover, the Proof of Deposit (POD) received by LPs acts as a certificate for their stablecoin deposit.

Neptune Mutual has introduced an innovative reward system through NPM emissions, specifically designed to benefit LPs who lock their POD tokens. By locking their NPM tokens, LPs can receive veNPM tokens, which boost their voting power in Snapshot voting and influence the liquidity gauge that determines the distribution of NPM emissions across the cover pools.

For more detailed insights into how our veNPM and liquidity gauge mechanisms work, be sure to check out our latest blog posts on the topic. The vote escrow feature is already operational on the Arbitrum network.

We also have a detailed tutorial on navigating the veNPM and liquidity gauge features on our YouTube channel.

Neptune Mutual stands out in the DeFi insurance landscape primarily due to its parametric cover approach, which simplifies and streamlines the process of assessing incidents and disbursing payouts.

This system is based on predefined parameters that determine whether an incident falls within the scope of coverage, eliminating the need for traditional proof of loss. This feature is especially beneficial for cover pool creators or product owners, as it allows them to set specific parameters tailored to the risks most likely to impact their communities. By aligning the cover parameters with probable risks, product owners can provide targeted and effective protection, enhancing the relevance and appeal of their cover offerings.

Another significant advantage is the speed of its payout process. As a parametric cover protocol that does not require proof of loss, Neptune Mutual can execute incident resolutions and hand payouts swiftly. This rapid response not only meets the immediate financial needs of the victims but also builds the trust of community members with the cover creators.

Neptune Mutual stands out in the DeFi insurance industry by offering innovative liquidity pools that empower both LPs and cover creators with unique advantages.

Through Dedicated and Diversified cover pools, participants can choose their investment style, whether focusing on a single project or spreading risks across multiple initiatives.

The platform's parametric cover approach eliminates the need for traditional proof of loss, streamlining the payout process and enhancing trust. Additionally, Neptune Mutual’s features like limited lock-in periods, high returns, and innovative rewards systems like NPM emissions make it a leading choice for those seeking to secure their investments and communities in the Web3 space.

We have a marketplace on Ethereum, Arbitrum, and BNB Smart Chain Networks for LPs to contribute liquidity, project owners to create cover pools, and crypto users to purchase cover policies.

To learn more about Neptune Mutual, follow us on X and connect to our Discord server.