Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

Neptune Mutual launches vote escrow feature and gauge emissions on Polygon Mumbai testnet.

Hello Neptunites! We are here with an exciting announcement.

We are thrilled to share that Neptune Mutual’s vote escrow and liquidity gauge is now live on the Polygon Mumbai testnet, offering our community members the chance to try out this new feature. veNPM offers enhanced voting power in relation to the allocation of NPM emissions, and, in addition, veNPM holders receive boosted NPM emissions.

In this blog, we are going to dive into the details of the vote escrow NPM tokens, liquidity gauge pool, and how the locking mechanism works.

Neptune Mutual is implementing rewards for Neptunite cover pool LPs in the form of NPM emissions. NPM emissions will be distributed to LPs who lock their PODs (Proof of Deposit tokens), as long as the pool that they have provided liquidity to is allocated NPM emissions by the liquidity gauge. The allocation of NPM emissions by the liquidity gauge is influenced by the votes of veNPM holders in Snapshot.

The Vote Escrow NPM, or veNPM token, is a governance token created with a non-standard implementation of the ERC-20 token standard. The veNPM token has two purposes. Firstly, it provides boosted NPM emissions, and secondly, it provides increased voting power to the veNPM holders.

Users can lock up their NPM tokens in the vote locker for a specific period of time to receive voting rights.

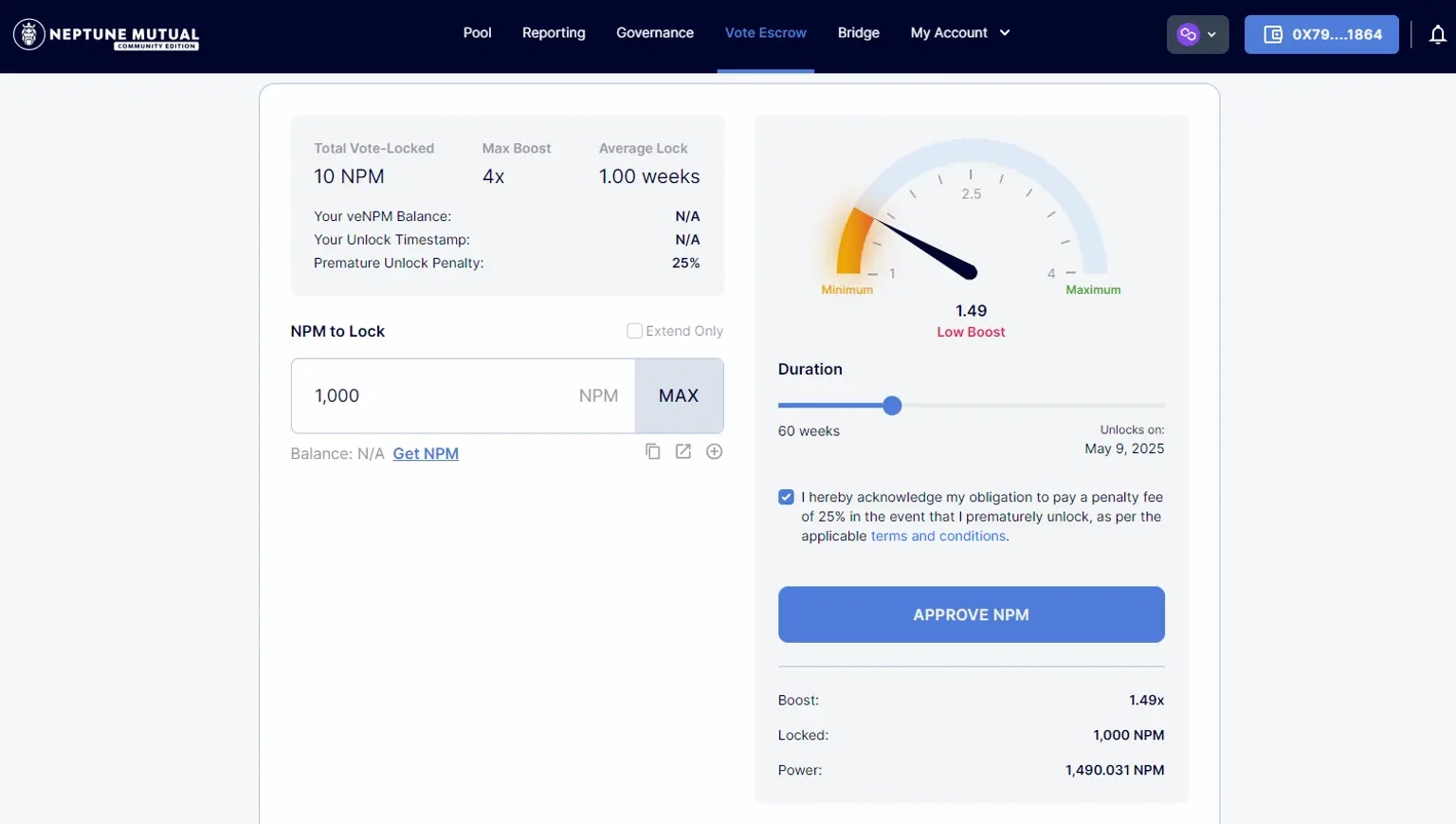

In the above image, 1,000 NPMs are locked for a duration of 60 weeks, which has increased the voting power to 1.49.

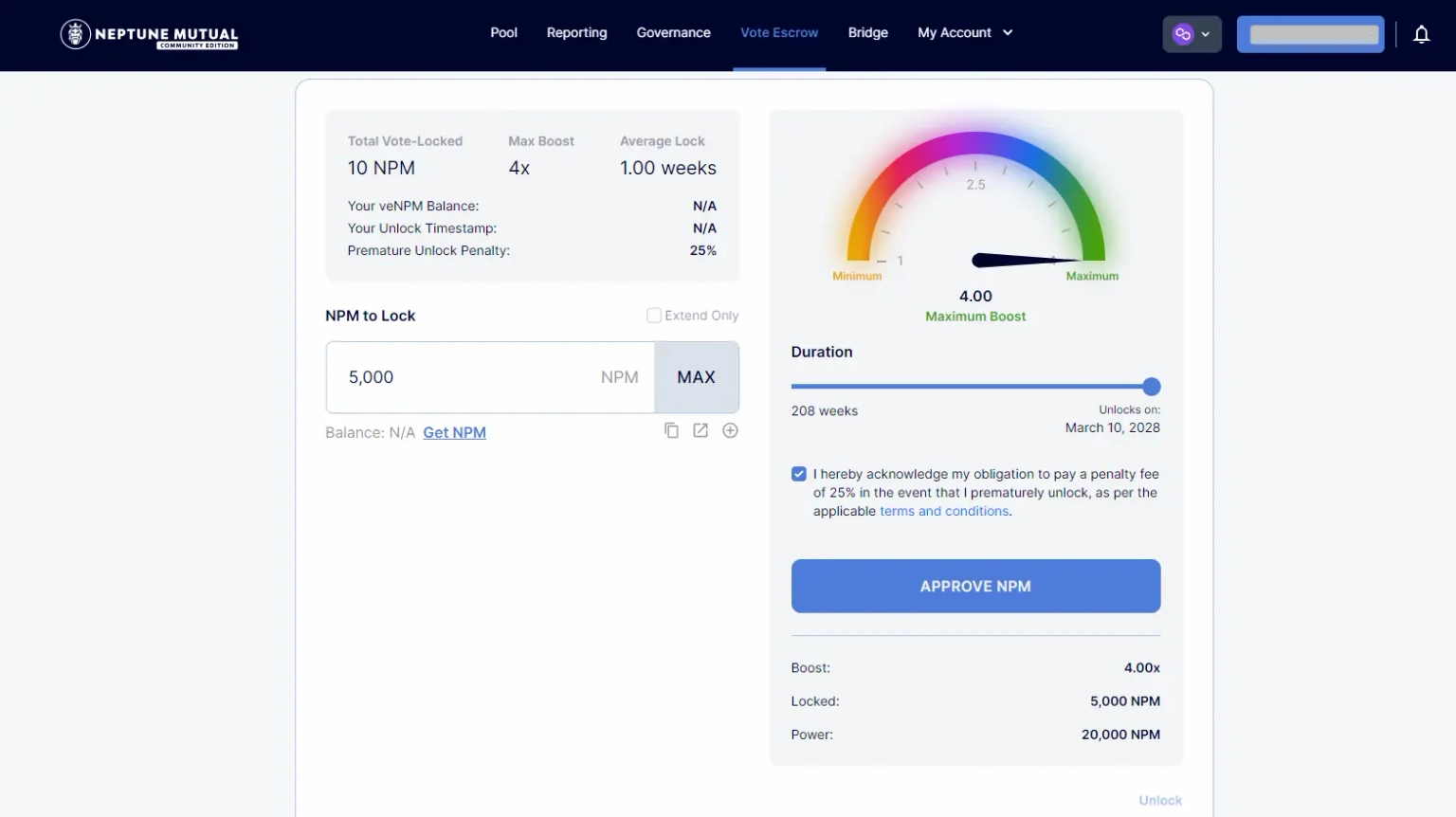

The longer a user locks their tokens, the more significant their voting power becomes. For instance, if the user locks their tokens for 208 weeks (the maximum locking period), their voting power will quadruple.

Once locked for a certain period of time, veNPM tokens cannot be transferred, and the balance remains constant throughout the lockup period. However, the boosted voting power gradually decreases until it reaches 1x, equivalent to a freely floating NPM token in the market.

The concept of veNPM is similar to that of Curve Finance’s vote escrow (veCRV) token. However, one key difference is the programming language used. While veCRV was developed using Vyper, we have used Solidity, the most widely used smart contract programming language, for the vote escrow feature implementation.

The liquidity gauge pool and gauge controller are responsible for the allocation of NPM emissions to different cover pools. It takes into account the number of NPM tokens to be emitted and the votes submitted by veNPM holders in Snapshot voting.

So, veNPM holders with the most voting power can influence the allocation of the NPM emission in their favor. veNPM holders vote for the pools in which they have provided liquidity.

If you have significant veNPM tokens and voting power, this means you are in a stronger position to influence the gauge to allocate NPM emissions to the cover pools in which you are invested as an LP.

The testnet went live on March 13th, 2024. If you haven’t already checked it out, here’s the link: https://test.neptunemutual.net/vote-escrow

veNPM will be launching on the mainnet soon, so be sure to engage and test the different features of veNPM on the testnet.

To participate in the testnet and try out the vote escrow feature, you need to have testnet tokens in your wallet. You’ll need test NPMs to engage in the testnet and test MATIC tokens to pay for the gas fees.

To get hold of testnet tokens, you need to connect your wallet to different faucets and transfer them to your wallet. We’ll guide you through the whole process; just follow the below instructions carefully.

First, log in to your MetaMask or any other cryptocurrency wallet through its browser extension. Next, change your network to the Polygon Mumbai Testnet from the drop-down menu at the top of the wallet pop-up.

After that, create a new wallet address by clicking on the icon at the top-right corner of the pop-up. Finally, click [Create Account].

Now, let’s see the steps in obtaining the test MATIC tokens. You’ll need these to “pay” for the testnet gas fees needed to make transactions.

To acquire MATIC, open https://faucet.polygon.technology/ in your browser.

From the Polygon faucet page, you can request the MATIC tokens. Before that, it will prompt you to join Polygon’s Discord server, so be sure to do that.

After that, you can enter the wallet address at which you want to receive the tokens and click on [Submit].

Go back to test.neptunemutual.net/vote-escrow after you complete the transaction.

Once you’re there, click [Connect Wallet]. Choose Metamask or any other wallet you use. Then, select the wallet in which you want to receive the tokens, in case you have multiple wallets in your account. Remember to select the same wallet where you received the test MATIC earlier.

After the wallet connects, click on Get Test Tokens at the top of the Neptune Mutual testnet page. It should take you to https://faucet.neptunemutual.com/.

Then, select the Mumbai network and click on [Connect Wallet]. Next, select MetaMask or, again, whichever crypto wallet you use.

On the right side of the Your Balances section, click Request beside NPM on the page. This should open your MetaMask wallet. After that, all you have to do is click on [Confirm] on the wallet pop-up, and you’ll have 2000 test NPM tokens in your wallet.

Once you’re done, you can now go to https://test.neptunemutual.net/vote-escrow to interact with the Neptune Mutual testnet. You can try out locking NPMs by entering the number of NPM tokens and lock-up duration.