Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

Understanding DeFi insurance and its importance in mitigating DeFi risks and threats.

The world of decentralized finance (DeFi) is a rapidly expanding frontier in the financial sector. With its roots in blockchain technology, DeFi offers a plethora of benefits, including decentralization, permissionless systems, self-executing smart contracts, and encryption to ensure security. However, as with any financial system, DeFi is not without its risks.

DeFi's potential lies in its ability to democratize finance by removing intermediaries and offering greater accessibility. The exponential growth of DeFi projects highlights its popularity and the trust users place in its underlying technology. However, this growth comes with increased risks, such as the loss of funds due to malicious attacks or hacks.

Given these risks, insurance in the DeFi space becomes crucial. It serves as a safety net, protecting investors from potential losses due to unforeseen circumstances.

This article delves into the concept of DeFi insurance, a critical solution to mitigate the risks associated with DeFi assets. Let’s start with understanding what DeFi insurance actually is.

DeFi insurance is an innovative solution designed to safeguard investors against various risks in the DeFi ecosystem.

It’s an emerging aspect of DeFi and is based on the fundamental principles of traditional insurance, i.e., offering protection against financial losses. Different approaches have been taken by different DeFi insurance projects; however, they all use blockchain technology in a way that ensures transparency.

An investor with capital in a DeFi protocol can acquire insurance to mitigate the risk of smart contract vulnerabilities. Investors that deposit their digital assets in CeFi protocols can insure against custody risks, i.e., asset withdrawals being frozen by the CeFi protocol for an extended period of time.

Factors like the type of coverage, the provider, and the policy duration influence the premiums for such policies. However, it's vital for consumers to understand the risks their policy covers.

Some well-known DeFi insurance protocols include Neptune Mutual, InsurAce, Unslashed, Nexus Mutual, and so on, each offering different insurance models and their corresponding features and coverage options.

DeFi is a flourishing sector with over $46 billion in total value locked (TVL). Compared to that, DeFi insurance has a TVL of approximately $330 million, meaning only a small part (less than 1%) of the total investments in DeFi have been covered. This shows the need for robust insurance solutions is becoming increasingly evident.

When it comes to the different risks in the DeFi space, price volatility is one of the prominent ones. The fluctuation of crypto assets within very short periods is driven by market sentiment, regulatory news, technological advancements, and trends. Similarly, the DeFi ecosystem is rife with scams and fraudulent schemes. While offering freedom and innovation, the decentralized nature of the space also opens the door for malicious acts like rug pulls, Ponzi schemes, and various types of investment scams.

In addition to that, security risks in DeFi are a significant concern, encompassing a range of issues from technical vulnerabilities to sophisticated cyber-attacks. Phishing and flash loan attacks are some forms of attack that involve tricking and manipulating users. Smart contracts, despite their benefits, are not immune to vulnerabilities.

All these types of threats in DeFi can lead to the loss of users’ funds and investments. Given the probability and the serious consequences of these risks, purchasing cover protection for crypto digital assets is a wise move. By providing a safety net, it offers peace of mind to users and can encourage more participation and investment in the DeFi sector.

As the DeFi ecosystem continues to evolve and expand, the role of insurance is becoming increasingly vital in order for adoption to grow to a more widespread audience. DeFi insurance is an essential component in the future growth of the decentralized finance landscape, particularly for the onboarding of institutional investors for whom insurance is typically a precondition of business.

Parametric and discretionary solutions are the two models of asset coverage. Let’s understand both of them.

Discretionary insurance operates on a non-contractual basis, where the decision to pay out for a claim rests on the discretion of the provider. This model lacks a guaranteed payout, even if the claim appears valid under the policy terms.

The assessment of claims in this model is highly individualized, focusing on the specific circumstances and losses of each policyholder. This approach can lead to a lengthy and complex claims process, as each individual’s case requires a detailed evaluation to determine if it conforms to the policy's scope.

The discretionary model's approach enables users to insure their own specific assets, but users’ must accept the ambiguity of the discretion held by loss assessors to deny potentially valid claims.

Parametric insurance is defined by its reliance on specific parameters to trigger payouts. Parametric insurance is designed to provide financial protection against predefined events, paying out when these events occur, regardless of the actual loss suffered by the policyholder.

The parameters are required to be both clear and binary. The claim assessment process focuses on assessing whether the incident itself has triggered the policy parameters or not, and therefore just one decision is required, as opposed to all the individual assessments and decisions for discretionary cover. This leads to a substantially shorter time-to-payout following an incident with parametric policies. This model is particularly effective for managing risks that are challenging to predict and quantify, such as natural disasters or certain types of security risks in the blockchain space.

Let’s see some benefits and limitations of DeFi insurance.

Reduced Fraud Risk: In a decentralized system, the transparency and immutability of blockchain technology make it difficult to manipulate or falsify onchain data, leading to a more trustworthy system.

Community Participation: DeFi insurance often involves community participation in governance. Policyholders can have a say in key decisions, such as incident reporting, changes in policy terms, or claim adjudication. This participatory approach fosters a sense of ownership and alignment of interests among all stakeholders.

Complexity: Despite its advantages, DeFi insurance can be complex, especially for beginners. Understanding how smart contracts work, the intricacies of blockchain technology, and navigating the DeFi ecosystem requires a certain level of technical knowledge.

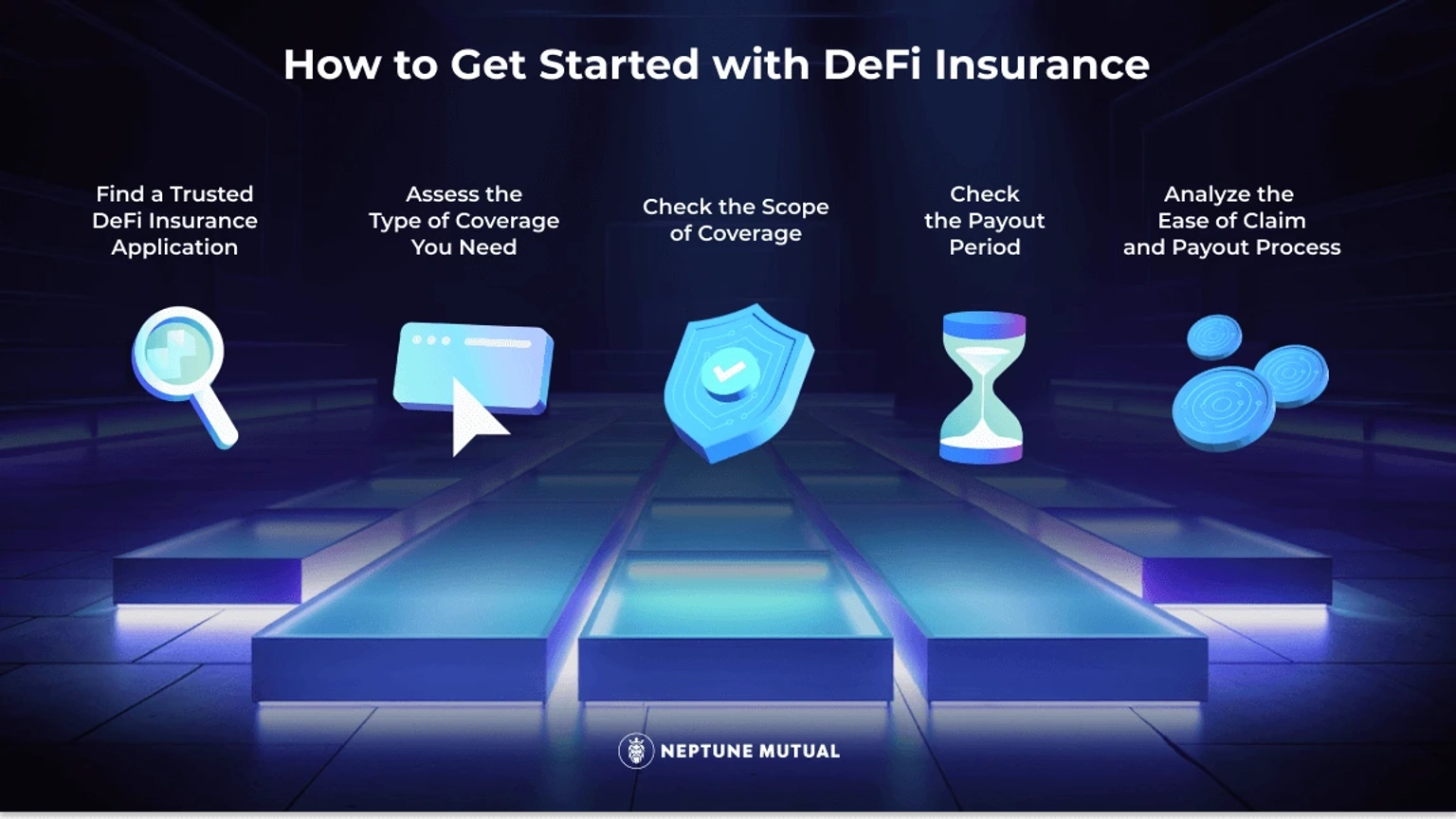

Purchasing a DeFi insurance policy involves several critical steps to ensure that you select the right coverage for your needs. Here's a more detailed breakdown of each step:

The first step is to identify a reliable and reputable DeFi insurance protocol. Given the handful of options on the market, thorough research is essential. Look for cover protocols that have a proven track record, positive community feedback, and transparent operations. Consider factors such as the protocol's history, smart contract audits it has undergone, and other benefits it provides. It's also helpful to participate in community forums to get a sense of the protocol's reputation and reliability.

Before purchasing a policy, it's crucial to understand what kind of risks you are looking to insure against. DeFi insurance can cover a range of risks, including smart contract vulnerabilities, centralized exchange custody risks, or even price drops. Assess your investment portfolio and identify where your vulnerabilities lie. Are you more concerned about technical risks, like smart contract bugs, or financial risks, like token price volatility? Understanding your risk profile will guide you in selecting the appropriate coverage.

Once you know what type of coverage you need, examine the specifics of what each policy covers. Policies can vary significantly in terms of what they insure against. Some might offer broad coverage, while others might be very specific. It's important to read the fine print and understand the terms and conditions. Pay attention to any exclusions or limitations in the policy to ensure that it aligns with your expectations and requirements.

The payout period is a critical aspect of any insurance policy. In the event of a claim, knowing how long it will take to receive the payout is essential for financial planning. DeFi insurance protocols can vary significantly in their payout periods, dictated by the system of coverage they operate on. Understanding this timeframe helps in managing expectations and planning for contingencies.

A straightforward and transparent process is crucial when you need to make a claim. Look into how claims are done, the required steps, and the overall process. Some protocols might have automated claim processes, while others may require manual intervention. A user-friendly interface and clear guidelines can significantly ease the process.

While the steps for purchasing insurance coverage can vary across different DeFi insurance protocols, here we are guiding you through the process specifically for Neptune Mutual. We designed Neptune Mutual for ease of use, ensuring a straightforward and user-friendly experience in securing your DeFi investments.

So, here are the steps involved in covering your assets with Neptune Mutual:

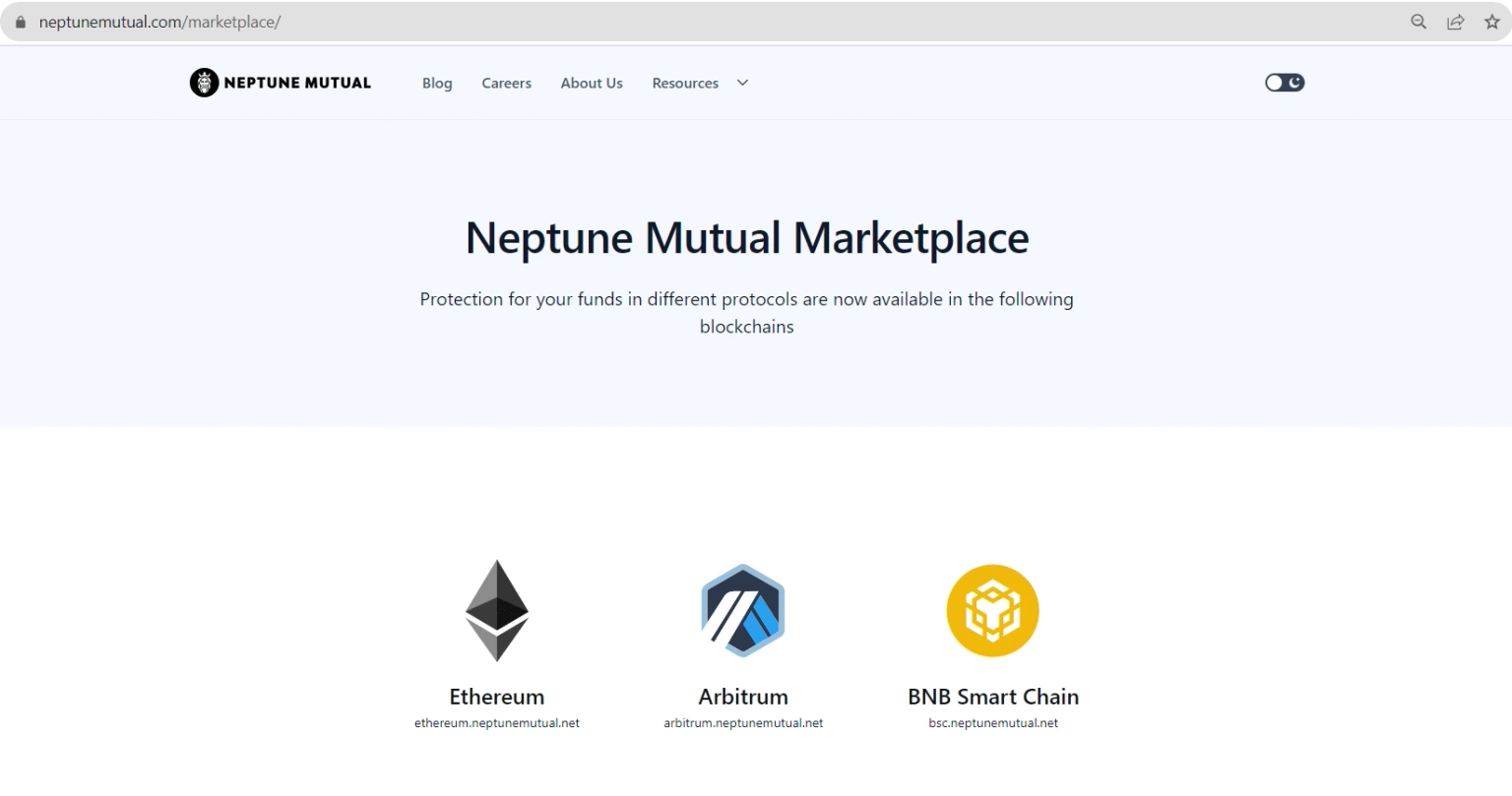

Start by navigating to the Neptune Mutual marketplace. This is the platform where you can browse and select various insurance coverage options.

Neptune Mutual offers coverage on multiple blockchain networks: Ethereum, Arbitrum, and BNB Smart Chain. It's important to choose the chain that aligns with where your assets are or where you're most active in DeFi.

Once you've chosen the chain, the next step is to select a cover pool. A cover pool is essentially a specific insurance product focused on a particular protocol or risk. Browse through the available options and select the one you're looking to cover. After selecting a cover pool, proceed to the next page and choose the “Purchase Policy” option.

Now, you need to specify the amount you want to cover. If you haven't connected your digital wallet to the platform yet, you will be prompted to do so after this step. Connecting your wallet is essential, as it facilitates the payment of the premium.

After that, choose the duration for which you want the coverage. Neptune Mutual typically allows you to cover your funds for a period ranging from 1 month to 3 months. Select a time period that best suits your needs, keeping in mind that the risk exposure and the premium cost may vary based on the duration of the coverage.

Lastly, complete the on-screen prompts to make the payment. This final step will finalize your insurance cover purchase, ensuring that your assets are protected for the selected period.

We have several tutorials on our YouTube channel to help you purchase a cover.

Neptune Mutual stands out as a pioneering force in the DeFi insurance sector. It’s the first parametric insurance protocol created for the Ethereum network, showcasing a significant advancement in decentralized insurance solutions.

We offer a cover marketplace where projects can create cover pools for their products. Users who have invested in the product can purchase the available cover. In the event of a successful incident resolution, Neptune Mutual facilitates immediate stablecoin payouts. This process is streamlined and user-friendly, requiring no personally identifiable information, loss of evidence, or waiting for a verdict.

While Neptune Mutual is primarily focused on Ethereum, it also extends its services to other networks. The platform currently supports Arbitrum, Ethereum, and BNB Smart Chain, providing a range of options for users across different blockchain environments. This multi-chain approach allows users to secure their favorite DeFi, CeFi, and Metaverse apps, offering a versatile and comprehensive insurance solution.

However, Neptune Mutual is more than just an insurance portal; it has different features that offer a variety of benefits to different users of the Neptunite ecosystem including cover purchasers, liquidity providers and token holders. Neptune Mutual also offers guidance on strengthening security and has an active community interested in improving the security of the blockchain space.. Here are some of the additional offerings of Neptune Mutual.

Furthermore, we have a handful of new features coming up that benefit the Neptunite community.

If you are a blockchain project owner looking to protect your protocol and your community, then you might want to create a cover pool in our marketplace. You can reach us through our contact page so we can discuss further.