Protecting Your Intellectual Property in Web3

Learn about the effective strategies to protect your intellectual properties in Web3.

Youtube Video

Playing the video that you've selected below in an iframe

Understand what parametric cover is including its significance in the DeFi and Web3 space.

The blockchain space is a frontier of modern finance with the advent of DeFi, and it’s marked by its potential for growth and innovation.

However, the Web3 and Decentralized Finance (DeFi) space is full of challenges, including market volatility, fraudulent schemes, cyberattacks, and smart contract vulnerabilities. These risks underscore the need for robust protective measures to secure investments and digital assets and maintain trust in this innovative financial landscape.

In this context, DeFi insurance has emerged as a crucial tool. It assists in reducing the financial repercussions of these risks by offering payouts. Due to the number and intensity of the threats in blockchain space, insurance has become a necessity rather than just a luxury.

However, the unique nature of risks in the blockchain world demands innovative insurance solutions. This is where parametric covers come into play, offering a tailored approach to ease payouts and reduce the intricacies of insurance claims.

So, let’s start with understanding what parametric cover is.

A parametric cover represents an innovative form of insurance policy designed to address the specific needs and challenges. It structures its coverage around a set of predefined parameters or metrics, unlike traditional indemnity policies that reimburse the actual loss incurred.

The essence of a parametric cover lies in its simplicity and efficiency. The only requirement for parametric coverage is setting parameters. When a predefined event or parameter is triggered—say, a river rises above a predefined threshold during a flood, or a cyclone reaches a certain height—the cover immediately pays out a set amount. This approach eliminates the need for lengthy assessments and claim processing that are typical of traditional indemnity insurance.

Parametric covers are particularly effective in situations where quantifying losses is complex and time-consuming. For instance, in the case of damages caused by wildfires, where the extent of destruction can be challenging to assess immediately, parametric covers provide swift financial support based on the severity of the event as measured against the agreed parameters.

Parametric covers can be an effective and efficient solution in the blockchain space. It can be designed to trigger payouts based on specific events and parameters, like a drop in token values below certain thresholds, a significant hack causing the loss of specific amounts, or predefined smart contract failures, loss of NFT ownerships, and so on.

This innovative approach to insurance aligns perfectly with the dynamic and fast-paced nature of the blockchain world, offering a streamlined, transparent, and reliable way to manage risk.

One might think of traditional ways of assessing risks, and the claim adjustment process could work just fine. However, traditional insurance models are often discretionary and could fall short of addressing the unique challenges and risks inherent to blockchain-based assets.

These challenges stem from the digital assets' intangible nature, their reliance on rapidly evolving technology, and the decentralized framework in which they operate.

The high volatility of cryptocurrencies can lead to large fluctuations and crypto crashes, making it challenging to set premiums or assess potential losses. Additionally, the decentralized nature of blockchain technology complicates the process of identifying and verifying claims, as there is often no involvement of central authority.

Another significant challenge is the pace of technological change in the blockchain industry. Discretionary insurance models, with their lengthy underwriting processes and rigid policies, could struggle to keep up with the rapid development of new blockchain technologies. This disconnect means that the adoption of the parametric model of insurance in the Web3 space is the best way to provide adequate coverage for the associated risks.

The concept of parametric coverage revolves around setting predefined parameters or conditions, which, when met, automatically trigger a payout. These parameters are closely aligned with the risks inherent in blockchain transactions, such as smart contract vulnerabilities, security risks, social engineering, or significant cryptocurrency price drops. Focusing on specific, measurable events offers a more direct and efficient way to manage the risks associated with digital assets.

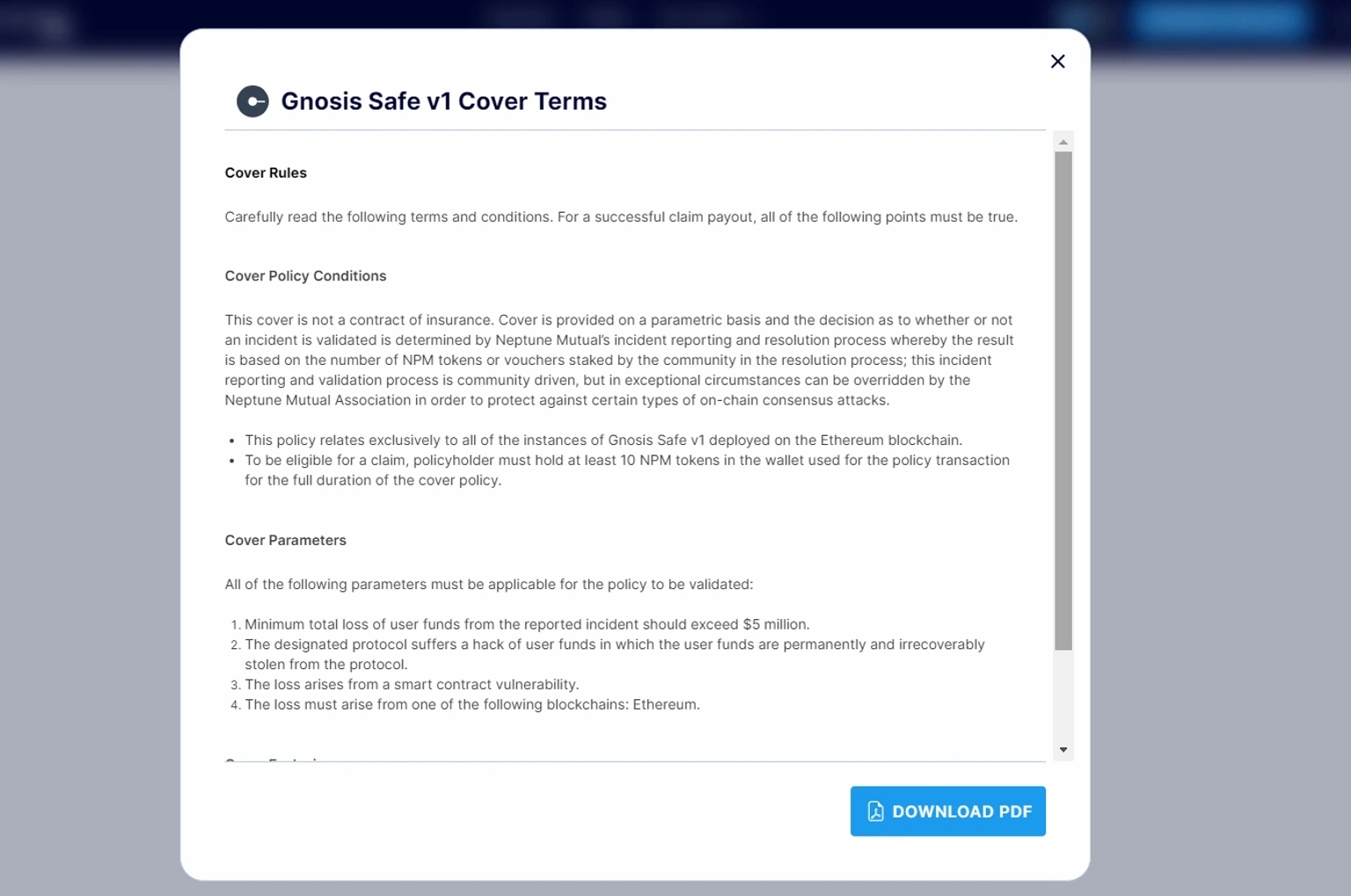

Here’s an example of predefined parameters for a cover product in Neptune Mutual.

Parametric covers bring a set of unique features well-suited to the dynamic and decentralized nature of the blockchain space. These features offer a more streamlined, efficient, and transparent approach to risk management.

Here are some of the features of the parametric coverage model.

In standard insurance models, when a loss occurs, policy holders have to go through a complex and often time-consuming process of claim filing, investigation, and adjustment. This process requires assessing the extent of the damage, interpreting policy terms, and determining the appropriate payout—a procedure that can be subjective to disputes.

However, parametric covers are designed around specific, measurable parameters. The policy automatically initiates a payout when it meets these predefined criteria. This mechanism bypasses the need for traditional claim assessment, thereby streamlining the process and ensuring a swift response to the policyholder's needs.

Parametric cover protection stands out for its objective and predictable payout process. Parametric covers are based on predefined triggers and are not subject to assessment or interpretation. These triggers are clear, measurable, and agreed upon at the outset of the policy. When these triggers are met, the payout is automatic, eliminating ambiguity and ensuring a transparent and predictable response to events.

In addition, there is no lengthy negotiation or claim verification process. This rapid response is particularly crucial in the blockchain space, where market conditions and asset values can change rapidly. This rapid response is crucial in the blockchain space, where conditions can change rapidly and delays can have significant financial implications.

The parametric model inherently reduces the risk of insurance fraud. Traditional indemnity-based policies can be susceptible to exaggerated or fraudulent claims as they rely on subjective assessments of loss. In contrast, parametric covers are based on objective and verifiable data, making it much harder to manipulate claims. The transparency and simplicity of the trigger events add an additional layer of security and trust to the process.

The effectiveness of a parametric cover heavily relies on the careful selection and setting of trigger parameters. The parameters should be clear, measurable, and relevant, ensuring that the cover provides meaningful protection without unnecessary complexity.

Setting appropriate triggers involves understanding the nature of the risk, historical data, and the potential impact on the policyholder. For instance, in a blockchain context, if the cover is for exchange hacks, the trigger could be set based on the size of the hack or the type of assets affected.

Parametric coverage does not require individual claim assessments, which is a significant feature in contrast to traditional insurance models. This feature not only speeds up the claims process but also reduces administrative costs and complexities associated with claim handling. Once the parameters are met, all the policy purchasers will be paid at once, with no disputes or delays.

Let us introduce Neptune Mutual, the first parametric insurance protocol built on Ethereum. It has pioneered a distinctive approach to parametric cover in the blockchain space, offering a model that is both innovative and aligned with the specific risks of digital asset transactions.

Neptune Mutual is built around the concept of parametric triggers that are predefined and transparent. This means that users have easy access to viewing the cover parameters and associated terms.

These triggers could be based on specific events or incidents, such as smart contract breaches, exchange hacks, or significant price drops that could cause loss of funds or digital assets. When these triggers are met, the parametric cover policy automatically initiates a payout, ensuring a swift and objective response to the insured event.

We have a unique way of addressing the occurrence of incidents by allowing users to report the incidents and earn rewards for participating in the ecosystem.

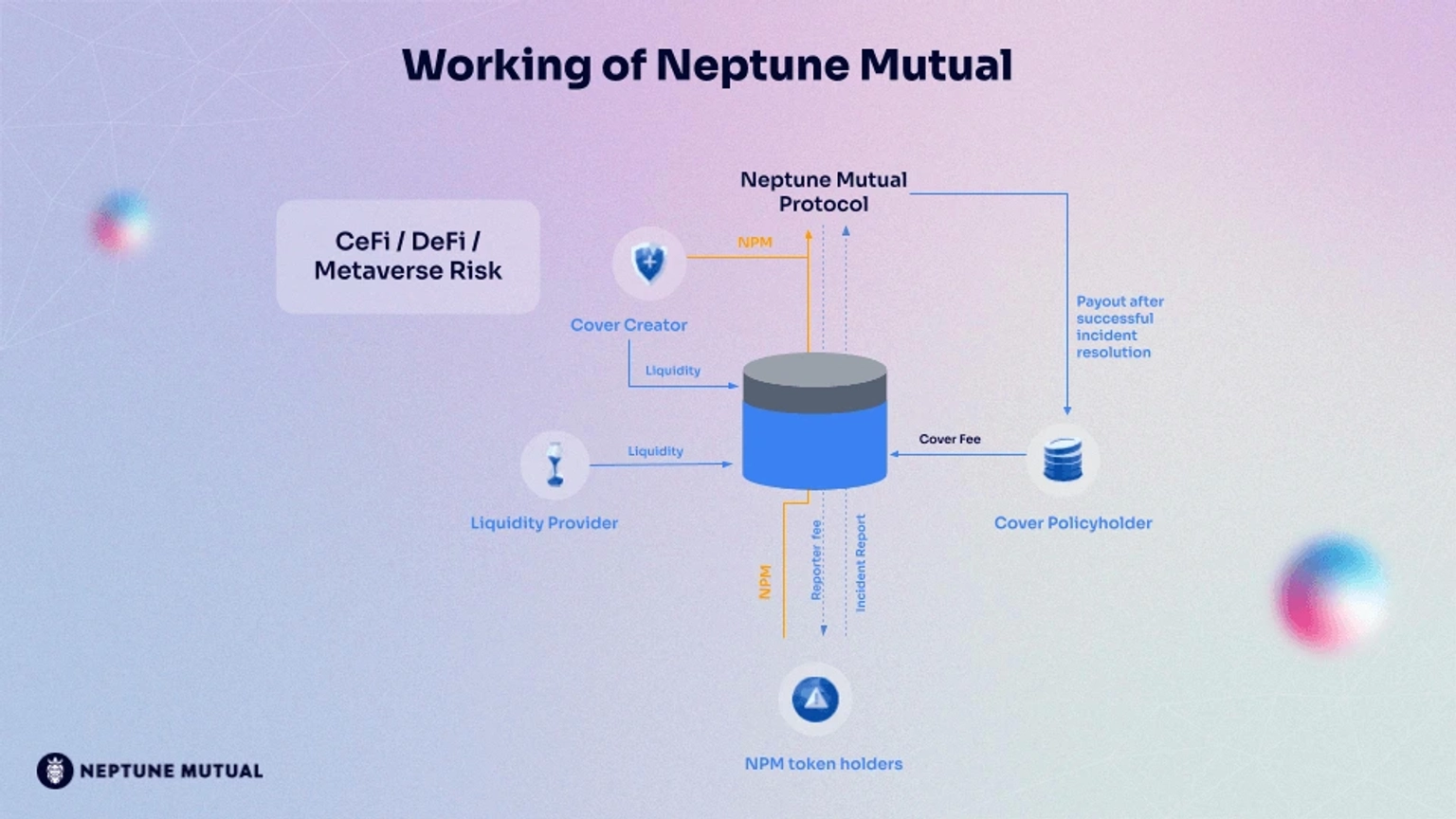

Neptune Mutual is actually a cover marketplace, meaning projects in Web3 can create cover pools, liquidity pools for their projects in our portal. Users who have funds invested in the projects can purchase the available cover policies. In addition to that, LPs can add liquidity to those pools, increasing the cover purchase capacity of the pool.

If the project suffers incidents triggering the predefined parameters, we facilitate a quick stablecoin payout to the policy holders.

Here is a simplified figure depicting how Neptune Mutual works.

Take a look at Neptune Mutual’s documentation to get an in-depth idea of how we operate. There you can also find information on several other offerings of Neptune Mutual, like the Neptunite NFTs, NPM tokens, staking options, governance, and more.

Our marketplace is available in Ethereum, Arbitrum, and BNB Smart Chain, offering a wide range of coverage options in different networks.

We encourage blockchain project owners to create cover pools in our marketplace to secure their projects and communities. Reach us through our contact page so that we can help you create the cover pools that fit your needs.