What Is the ERC-1404 Token Standard?

Learn about ERC-1404, the token standard introducing restrictions in security tokens.

Youtube Video

Playing the video that you've selected below in an iframe

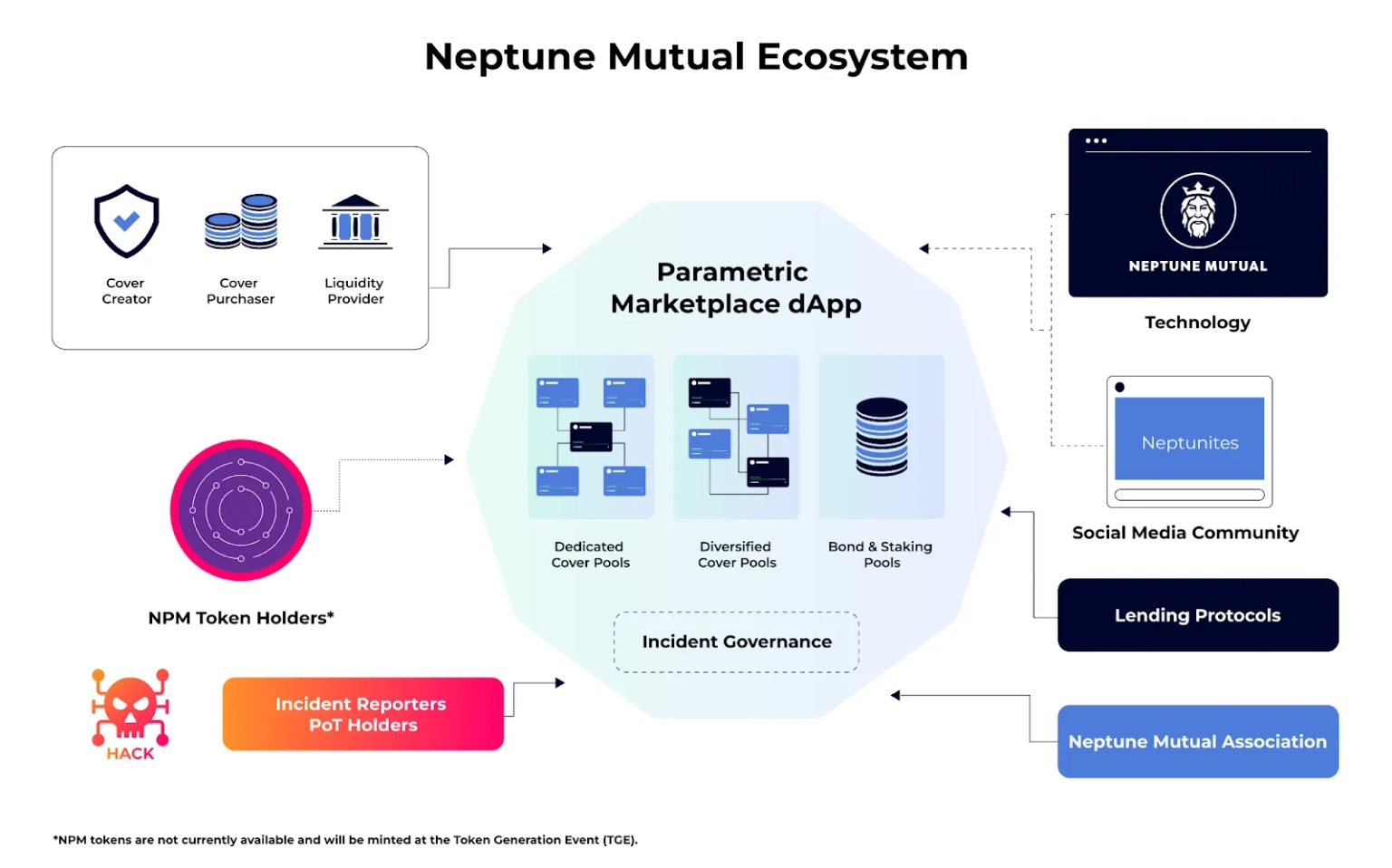

Learn about the different actors of Neptune Mutual ecosystem that interact with the marketplace.

Neptune Mutual is a marketplace for parametric cover policies. In this blog we thought we would describe the different actors of the Neptune Mutual ecosystem that interact with the marketplace.

Neptune Mutual is the project name of the marketplace. The Neptune Mutual team works for a technology development company that has created the frontend application and corresponding smart contracts that enable the functioning of the marketplace. The Neptune Mutual development company does not create its own cover pools, sell cover policies, and it does not provide any liquidity to any of the cover pools in the Neptune Mutual marketplace.

The marketplace is moderated and operated by an association, called Neptune Mutual Association, located in Zug, Switzerland.

Neptune Mutual Association is a not-for-profit entity that does not participate in any commercial activity within the marketplace. Its primary role is to moderate the marketplace, and in particular to oversee the correct operation of the event reporting and incident resolution process. Note that the association is not a DAO, and is not, at least for the time being, decentralised. That being said, the association has been set up as the first step towards decentralising the governance of the protocol. The Chairman of Neptune Mutual Association is Hans Koning, advisor to Neptune Mutual from day one (but not a co-founder).

The role of the association is to intervene in exceptional circumstances in order to protect the integrity of the Neptune Mutual ecosystem. By way of example, the governance committee has the power to pause the protocol (or the cover pool in question) in the event that the incident reporting process suffers a 51% attack. The governance committee also has the power to perform emergency resolutions to reverse incident reporting decisions in the event of malicious activity. It is not within the remit of the association to intervene in the normal course of the incident reporting process.

As the protocol develops over time the plan is to transfer more responsibility and powers to the Association such that it can eventually manage the operations of the marketplace completely as an autonomous entity.

There are a number of different ways of interacting with the marketplace application that broadly speaking can be covered by the following categories of activity: cover creation, cover policy purchase, provision of liquidity (LP), reporting and resolution, and staking/bonding activity.

It is expected that all cover creators will be incorporated companies, and, in most cases, they will be the company that has developed the blockchain project for which the dedicated cover pool, and the associated cover policy, is being developed to protect. For diversified cover pools, cover creators will again be incorporated companies, and they may or may not be linked to the portfolio of projects that the diversified cover pool provides underwriting liquidity to.

The main point to note is that the Neptune Mutual team retains the right to determine whether an organisation can participate in the marketplace or not. A variety of factors will be considered including the type of risks that the cover creator would like to design a policy to mitigate (in the first instance these should relate exclusively to security risks), and most particularly the Neptune Mutual team will pay particular attention to the security measures put in place to minimise security risks occurring.

Once the marketplace launches on mainnet then anyone that fulfils the criteria of the terms and conditions of the marketplace can participate in purchasing a cover. We encourage all users to read the terms and conditions carefully to ensure that you are not excluded by any of these terms.

As the name suggests, liquidity providers provide liquidity to the two different types of cover pool that exist in the marketplace: dedicated or diversified. As long as users conform to the terms and conditions of the marketplace, then any of the actors within the Neptune Mutual ecosystem can become liquidity providers. Typically, we expect cover creators to inject the initial liquidity into their cover pools, and then provide a number of different incentives to encourage their respective communities to participate in providing liquidity as LPs.

Cover pools in the Neptune Mutual marketplace supply a certain amount of “excess” liquidity to lending protocols, such as AAVE, in order to optimise the returns for liquidity providers.

An important feature of the Neptune Mutual protocol is the community-based reporting and incident resolution system. This has been designed with careful consideration given to the incentive mechanism that encourages honest reporting of events through the use of staking of NPM tokens. This is one of the key utility functions of the NPM token, and others are currently in development.

As additional utility of the NPM token is being developed, the marketplace application will launch before the NPM Token Generation Event (TGE). This means that an interim reporting and incident resolution will be used until such time as NPM tokens are in circulation and NPM token holders are available to participate, as planned. The interim reporting and incident resolution will be based on the existing model, albeit with PoT (proof of authority tokens) as opposed to NPM tokens. PoT tokens will be held by a small and limited “community” and the process will be governed by the Neptune Mutual Association.

The staking and bonding features of the marketplace application depend upon the availability of NPM tokens. These features will therefore not be available immediately at the mainnet launch, but will be activated following the TGE event. As with other features of the marketplace, all actors will be able to participate and benefit from these features.

Over and above the close collaboration with cover creators for dedicated and diversified cover pools, Neptune Mutual anticipates partnering with a certain number of external entities that can provide complementary services to the marketplace, such as, for example, reinsurance.

The first strategic partnership is with Cover Capital Ltd, a DeFi company specialised in the provision of liquidity to DeFi pools. For cover creators that are looking to bootstrap liquidity for their cover pools, Neptune Mutual can connect them to Cover Capital Ltd who will review the specifics of the cover pool liquidity opportunity. Neptune Mutual is also working with Cover Capital Ltd in the expectation that Cover Capital Ltd may create and fund initial liquidity into a diversified cover pool for Prime dApps.

We coined the term “Neptunites” to refer to our community of supporters across the different social media platforms that we use. Neptune Mutual is acutely aware of the importance of fostering a healthy and engaged community. There is a great deal of work to be done to increase the adoption of digital asset protection in the blockchain industry, and much of this work centres around encouraging users to learn about the challenging and technical subjects of blockchain security and the different ways of mitigating security risks when security is breached. We owe a great deal to the efforts already made by our community in shaping the design of our application, and we intend to continue encouraging this engagement and help through a variety of means.