Liquidity Gauge Pools (Draft)

This document is a draft and likely to change.

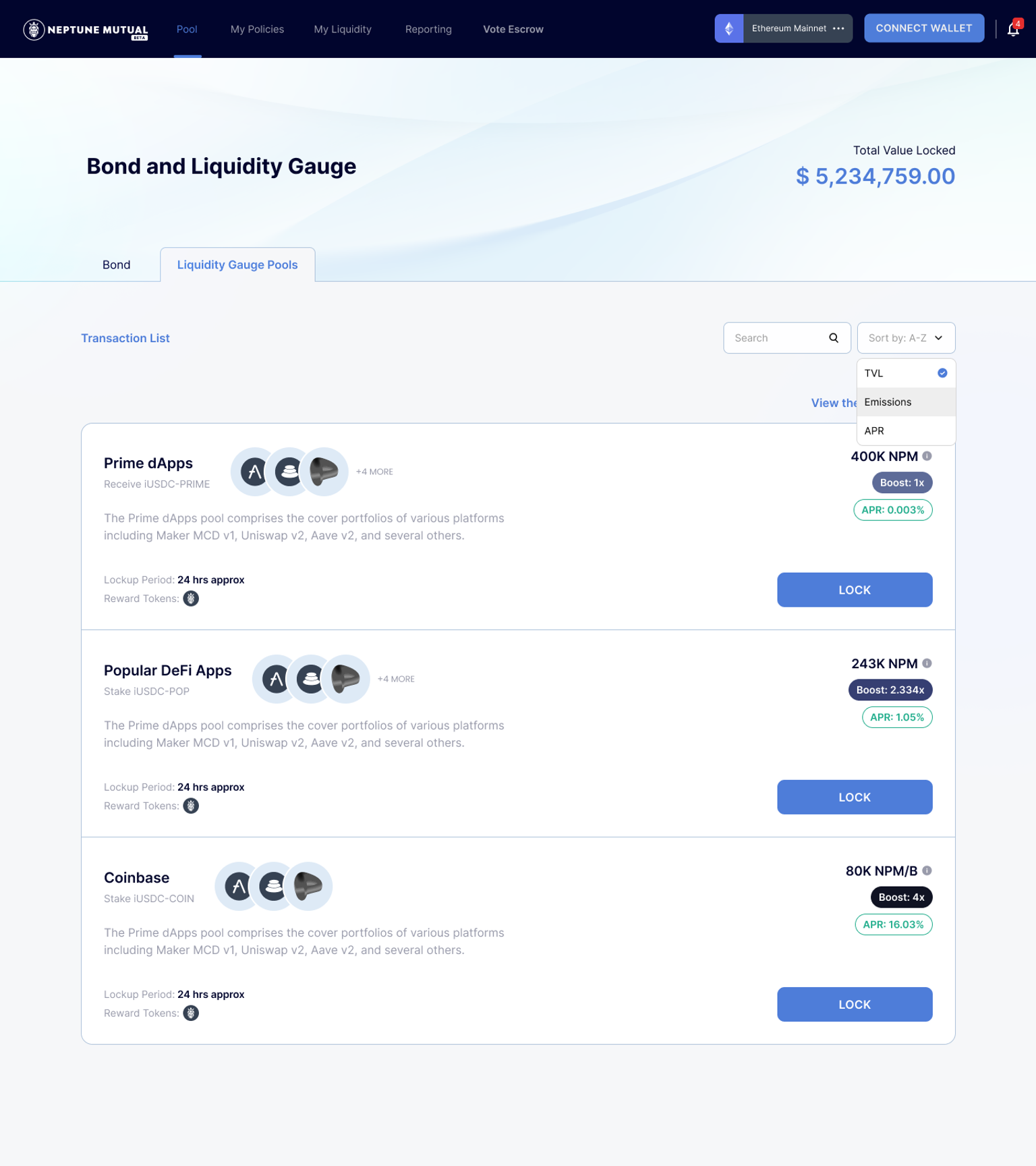

The liquidity gauge pools are designed to measure the locked POD (Proof of Deposit) liquidity and distribute block emissions to liquidity providers in a fair and proportionate manner. This system not only incentivizes users to contribute to the platform's liquidity but also rewards those who hold veNPM tokens by offering boosted NPM emissions and increased voting power.

In the absence of veNPM tokens, the liquidity gauge would distribute NPM block emissions evenly based on the units of locked PODs. Every user who provides liquidity would receive rewards in direct proportion to their contribution. This equitable distribution mechanism ensures that each participant is appropriately compensated for their stake in the platform's liquidity pools.

However, the introduction of veNPM tokens adds opportunity to the users who hold veNPM tokens. The veNPM holders enjoy a boost in both their NPM emissions and voting power, providing them with greater influence over the distribution of block emissions to various liquidity pools. This boost is contingent upon the duration of their NPM tokens being locked – the longer the lock period, the greater the boost.

In a scenario where all users have veNPM tokens with the maximum boost and equivalent units of locked PODs, the distribution of NPM block emissions would remain proportionate, just like the situation with no veNPM tokens. This ensures that even in a fully boosted environment, the rewards remain equitable among all participants.

However, when some users hold veNPM tokens while others do not, the boosted voting power associated with the veNPM tokens comes into play. This allows users with veNPM tokens to attract a larger share of the block emissions, effectively increasing their rewards as compared to users without veNPM tokens.

The liquidity gauge system's design enables users to redirect block emissions to their preferred liquidity pools without incurring significant gas fees. This further enhances the user experience and makes the platform more attractive to a broader range of participants.

Benefits#

- Incentivized Participation: By rewarding users with NPM tokens for staking their liquidity provider (LP) tokens, the liquidity gauge pools incentivize users to actively participate in the platform. This not only increases the liquidity in the protocol but also encourages users to engage with the community and contribute to the platform's long-term success.

- Boosted Rewards and Voting Power: The veNPM tokens enable users to receive boosted NPM emissions and increased voting power. This additional incentive encourages users to lock their NPM tokens for longer periods, resulting in greater commitment to the platform and its governance. In turn, this fosters a stronger sense of community as users become more invested in the platform's growth and development.

- Decentralized Governance through Gauge Registry: The gauge controller registry, in conjunction with the liquidity gauge pools, empowers users to vote on proposals that redirect NPM emissions to their favorite insurance pools. By giving users the ability to influence the allocation of rewards, the platform fosters a sense of ownership and encourages users to take an active role in its governance. This democratic approach to decision-making aligns the interests of the community and ensures that the platform evolves in a way that benefits all stakeholders.

- Collaboration with Third-Party Protocols: The Neptune Mutual ecosystem's design allows third-party protocols to provide their native tokens as rewards to veNPM token holders. This encourages the redirection of NPM token emissions to their insurance pools, attracting more liquidity providers in the process. This collaborative aspect promotes community alignment by fostering partnerships and synergies between different protocols within the DeFi space.

- Gas-Efficient Voting: The liquidity gauge pools feature a gas-efficient voting system that enables users to redirect block emissions to their preferred liquidity pools without incurring any gas fees. The gauge setup gas fee is paid by Neptune Mutual by charging a small platform fee. This not only enhances the user experience but also contributes to a more sustainable DeFi ecosystem that is accessible to a wider range of participants.