Understanding DePin and Its Benefits in Web3

A detailed guide on DePin, its benefits, challenges, key projects, and future potential.

Youtube Video

Playing the video that you've selected below in an iframe

Some recent hacks in DeFi and the role of parametric cover in mitigating DeFi risks

The allure of innovation and the potential for substantial returns in blockchain continue to draw a growing audience. DeFi, a transformative sector offering opportunities for financial transactions and asset management, has become a hub for cybercriminals to exploit weaknesses.

In the physical world, the concept of insurance is deeply established as an approach to risk management. From insuring homes against natural disasters to protecting vehicles against accidents or thefts, we routinely safeguard our tangible assets, even against minimal risks of loss. When it comes to digital assets, such as crypto, NFTs, and other DeFi assets, a noticeable gap exists in the adoption of similar protective measures.

Why is it that our digital assets remain largely unprotected? The answer lies partly in the novelty of the DeFi space and the lack of widespread understanding of the available options for mitigating these risks.

The digital bandits are constantly devising new methods to exploit vulnerabilities in smart contracts, exchange platforms, and wallet software, making the theft of digital assets a real and present danger.

Many users, whether due to a lack of awareness or an underestimation of the risks, have not yet embraced the idea of insuring their digital assets. This oversight can lead to devastating consequences, as seen in the numerous hacks and security breaches resulting in significant financial losses.

Through this blog, we want to emphasize the critical need for insurance in the DeFi space and its pivotal role in safeguarding digital assets.

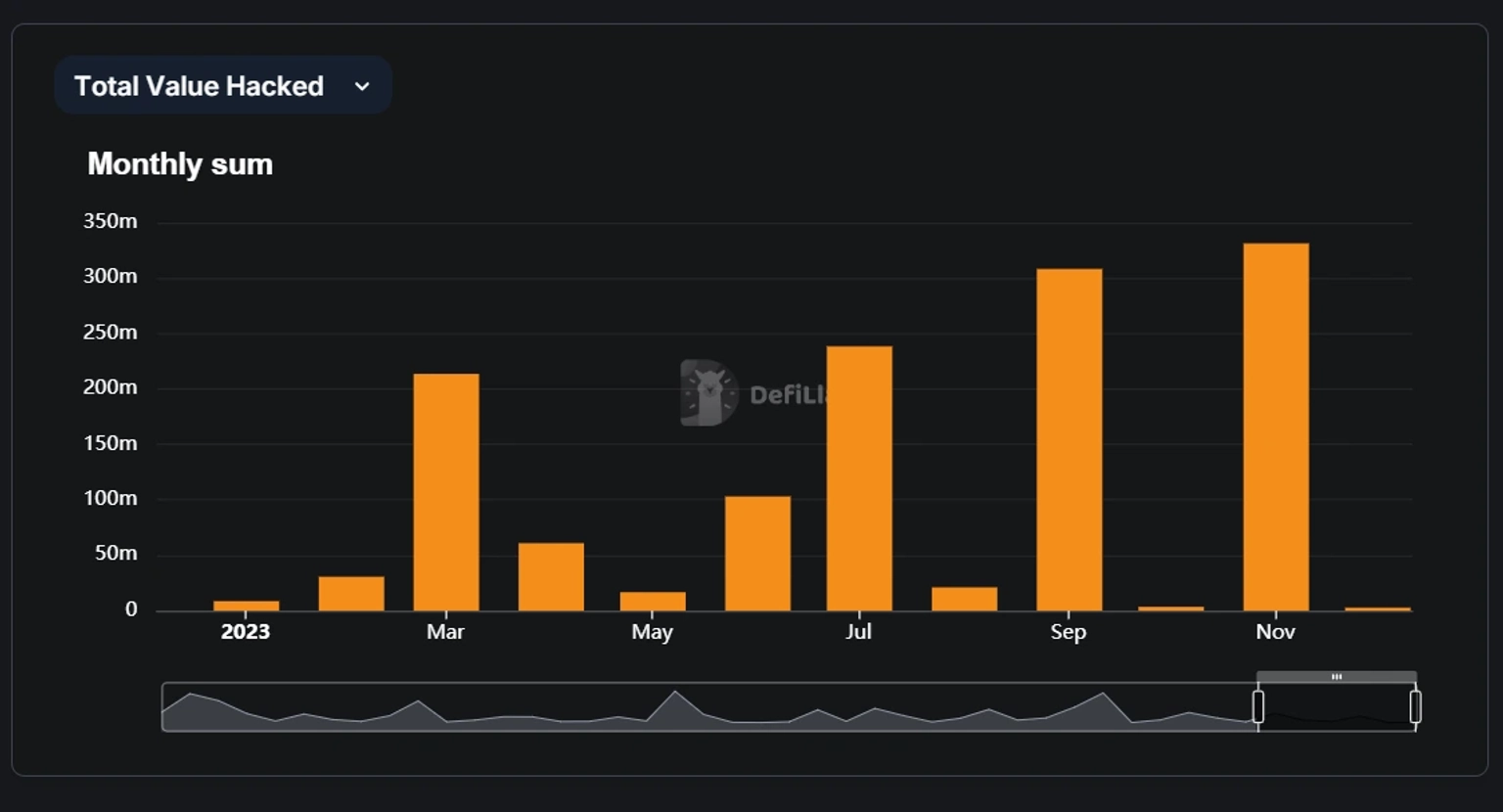

The latter part of 2023 has witnessed a disconcerting surge in DeFi hacks, underscoring the fragility of the current digital asset security landscape. November 2023, in particular, stands out as a reminder of the persistent threats in this domain.

In November alone, the DeFi community faced losses exceeding $331 million, as per DeFiLlama. This staggering figure represents the highest total loss in a single month throughout 2023.

Looking back a couple of months to September, the scenario was hardly any better. The losses then amounted to over $308 million, painting a worrying picture of the increasing sophistication and frequency of cyberattacks targeting DeFi platforms.

December 2023 continued this trend, with at least 20 known hacks adding to the tally of security breaches. Each of these incidents, varying in method and impact, contributes to a growing database of exploits that serve as a learning ground for both security experts and DeFi users.

Readers interested in learning more can check out our hack database, which is a comprehensive repository of information on all the DeFi and crypto hacks. In addition, the exploit analysis in our blog serves as a resource for those looking to deepen their understanding of these risks and ways of mitigating them.

On December 31, 2023, just a few days before writing this blog, Orbit Chain, a cross-chain bridge platform, suffered a significant exploit resulting in a loss of approximately $81.6 million. The exploit involved the misuse of valid signatures for unauthorized transactions, likely due to compromised private keys of the owner. The attacker executed a series of transactions, draining ETH, USDT, USDC, DAI, and WBTC from the Orbit Chain ETH vault. The attacker manipulated the withdrawal process by creating fake signatures.

On December 13, 2023, OKX faced an exploit on an old and abandoned market maker smart contract, leading to a loss of over $2.7 million. The root cause was likely the compromise of the private keys of the proxy admin. Attackers manipulated the DEX contract's claimTokens function, allowing unauthorized token transfers. The exploit involved upgrading the DEX Proxy contract to a new implementation controlled by the attackers, enabling them to steal tokens.

The Kyber Network, a hub of liquidity protocols, was exploited on November 23, 2023, across six different chains due to a smart contract vulnerability. The attack resulted in a loss of about $48.3 million. The attacker used flash loans to manipulate token prices and liquidity, exploiting Kyber's concentrated liquidity math, leading to an "infinite money glitch" and draining multiple pools.

On November 22, 2023, HTX (Huobi)'s hot wallets and its HECO Chain's Ethereum Bridge were compromised, resulting in a total loss of approximately $99.3 million. The exploit was due to a compromised operator account, allowing direct withdrawal of funds. The stolen assets included a variety of tokens such as USDT, HBTC, SHIB, UNI, USDC, LINK, ETH, and TUSD.

These incidents highlight the critical vulnerabilities in the DeFi space and underscore the importance of robust security measures and the need for effective insurance solutions to mitigate such risks.

The DeFi sector is rapidly embracing technological innovations to enhance security and safeguard assets against the increasing threat of hacks. One of the most critical advancements in this area is the implementation of comprehensive smart contract audits to identify vulnerabilities before they can be exploited.

The integration of Artificial Intelligence (AI) in security protocols is a significant development. AI algorithms are increasingly being used to monitor transaction patterns and detect anomalies that could indicate a hack. AI's predictive capabilities also help in foreseeing and mitigating risks based on historical data and emerging trends.

Blockchain technology itself is evolving to offer more secure frameworks. Innovations like layer-2 solutions, consensus mechanisms, and sharding are being developed to enhance transaction speed and security.

However, the question remains: is that enough? Despite these advancements, hackers continue to find loopholes and develop new strategies to breach these fortresses. The dynamic nature of cyber threats means that security measures must continually evolve. It's a constant race between innovators in security technology and cybercriminals.

The role of insurance in managing and mitigating risks has become increasingly vital. While technological innovations in security have been beneficial, financial protection with insurance is crucial as well.

Modern DeFi insurance policies have evolved to cover a broader range of risks, including smart contract failures, exchange hacks, and even losses due to operational errors. DeFi insurance protocols and marketplaces like Neptune Mutual, Nexus Mutual, and InsurAce offer tailored and flexible insurance solutions.

Moreover, some insurance providers are exploring parametric insurance models, where predefined conditions like a specific type of hack or a certain level of loss activate payouts. This model reduces the need for manual claim processing, ensuring faster and more objective payouts.

Parametric coverage in DeFi represents a transformative approach, offering a tailored solution to the unique challenges and risks inherent in digital asset transactions. Unlike traditional indemnity policies that reimburse the actual loss incurred, parametric insurance is structured around a set of predefined parameters or metrics.

When unfavorable incidents like smart contract vulnerability or loss of certain amounts occur, triggering predefined parameters, the policyholders become eligible for payouts. These parameters are clear, measurable, and relevant to ensure meaningful protection without unnecessary complexity.

This model of coverage eliminates the need for lengthy assessments and claim processing typical of traditional insurance models. It’s effective in situations where quantifying losses is complex and time-consuming.

Let us introduce Neptune Mutual. It is the first parametric DeFi insurance protocol built on Ethereum. It’s based around the concept of parametric triggers, which are predefined and transparent.

When these predefined triggers are met, users can claim their payout swiftly within a few days after incident voting and resolution. This mechanism ensures an objective response, providing timely financial support to the policyholders.

Users can easily access and understand the actual parameters and associated terms. The clarity and accessibility of these parameters allow us to ensure that users are well-informed about the covers they purchase.

Neptune Mutual also introduces an innovative approach to incident reporting within its ecosystem. Users are not only participants but also contributors in the Neptunite ecosystem, as they can report incidents and earn rewards for their active involvement.

Neptune Mutual functions as a cover marketplace where DeFi, CeFi, and Metaverse projects within the Web3 space to create their own cover pools. Users with investments in those projects can purchase the available cover policies, adding a layer of security to their digital assets.

Additionally, liquidity providers (LPs) have the opportunity to add liquidity to these pools, thereby increasing the capacity for cover purchases. In return, they receive a portion of the policy fees.

Taking proactive steps to safeguard your investments is essential, and covering your funds is the most effective way to do this. With the increasing sophistication of cyber threats, having a safety net for your funds and assets is crucial.

At Neptune Mutual, you can cover your funds for a wide range of products on different networks. Our cover marketplace is currently available on the Ethereum, Arbitrum, and BNB Smart Chain networks.

For blockchain project owners seeking to protect their products and communities, we facilitate creating cover pools. Interested projects can reach us through our contact page.