Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

In this blog, you will learn about the Defi hacks, and the role of cover protocols to mitigate it.

Insurance is a well known tool for mitigating risk. And if the volume of DeFi hacks and exploits over the last month alone are anything to go by, purchasing cover to mitigate this risk seems a wise move to safeguard your digital assets.

In the physical world individuals and businesses expect risks to be mitigated with insurance cover as a matter of course. Nobody would consider depositing their savings in a bank that wasn’t insured, or owning a house that wasn’t insured, or driving down the road in a car that wasn’t insured. So why is it, in the risky world of blockchain projects where there is so much media attention given to cybercriminals, hacks and theft of digital assets, that digital assets remain, for the most part, completely unprotected? This is a question that we covered, in part, in our blog article “Crypto Crash Heightens Awareness of Risks & Hacks”.

Let’s have a quick look at recent cybercriminal activity since that article was written.

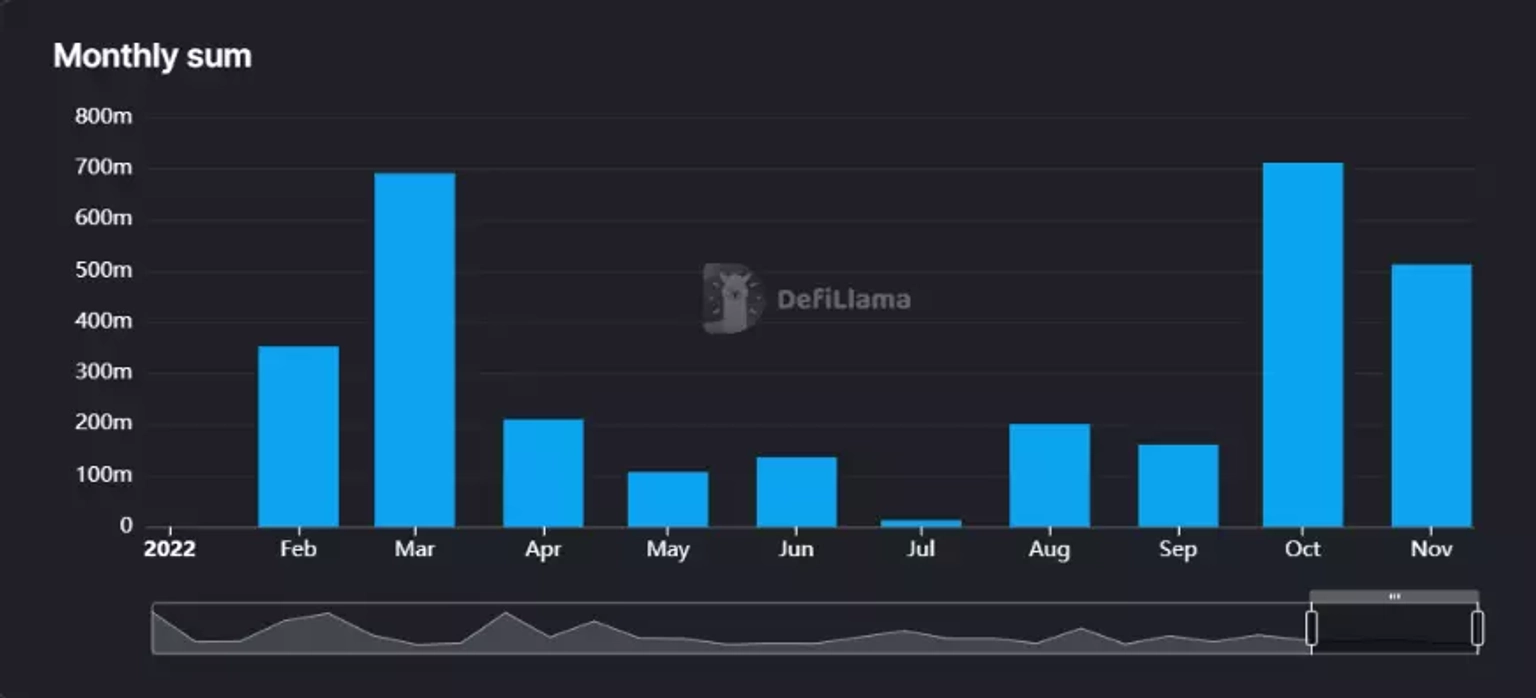

October was a profitable month for cybercriminals targeting DeFi dApps. data compiled by Defillama, the largest TVL aggregator for DeFi, shows an unprecedented increase in the volume of DeFi hacks in October 2022. In the space of one month, crypto holders and investors lost over $711 million, a whopping 430% surge compared to September’s figures at just over $165 million.

Snapshot of DeFi hacks tracked by month | Source: defillama.com/hack

With this, October now holds the record for having the most digital assets stolen from blockchain projects in 2022.

We’ve broken down the details of these smart contract hacks in our exploits analysis resource section. But let’s go over a few of the standout code vulnerability exploits that made the biggest headlines over the last few weeks.

On October 6, the BSC Token Hub, the internal cross-chain bridge of the BNB Chain ecosystem, was attacked. The hacker made off with over 2,000,000 BNB (around $566 million at the time).

The BSC Token Hub facilitates token transfers between the BNB Beacon Chain governance blockchain and the BNB Smart Chain (BSC) consensus layer. The root cause of the attack was a smart contract vulnerability, which the hacker exploited to mint two batches of 1m BNB. Even though much of the money has been made inaccessible to the hacker, this event remains one of the costliest hacks so far in 2022.

On October 13, 2022, centralized cryptocurrency exchange FTX was the victim of a gas-stealing attack in which the hacker exploited a vulnerability that allowed them to mint XEN tokens 17,000 times at zero cost. At the time of the event, the amount of loss was roughly around 81 ETH (just over $103,400).

However, that was only the beginning of FTX’s woes as just a few weeks later, the exchange was subject to another attack which saw it lose over $477 million in a suspected black hat theft. Unfortunately, this was the last straw for the cryptocurrency exchange as it filed for bankruptcy on November 11, 2022.

On October 17, PANews reported that the Metaverse DAO (MTDAO) project party had been exploited through a flash loan attack. The attack resulted in the loss of over 1900 BNB in which the hacker immediately transferred 1030 BNB to an external wallet.

On October 18, Moola Market, a popular DeFi lending protocol, was hacked for over $8.4M. The root cause of the attack was a price manipulation which allowed the attacker to drain multiple tokens, including millions of dollars worth of $CELO, $MOO, and $cEUR tokens.

By manipulating the price of the low-liquidity native $MOO token, the hacker was able to use them as a collateral to borrow huge sums of $CELO tokens repeatedly to take away the funds.

These are just a few examples of high-profile hacks resulting in millions of dollars worth of digital assets being stolen from blockchain projects in October 2022. November has already registered a few events, including the Skyward Finance Smart Contract Vulnerability attack on November 2, which resulted in a loss of around $3.2 million.

Mind you, many of these projects employed top-level security measures including code security audits, and yet, they were exploited for significant sums. With uncertainty continuing to abound among blockchain communities, perhaps now’s the best time to look at insurance solutions as a viable safety net for when traditional protocol security measures fall short.

Decentralized finance (DeFi) insurance is important for a few reasons.

First, it helps to protect users against potential losses due to hacks, scams, or other risks associated with DeFi protocols and decentralized applications (dApps). As we have just seen above, hacks are on the increase so the risk of losing digital assets to cybercriminals is very real. Without insurance, users of CeFi and DeFi have to bear the full cost of any losses they incur, which could deter them from using these platforms altogether.

Second, DeFi insurance helps to promote confidence and trust in the DeFi (and CeFi) ecosystem. By offering insurance, DeFi protocols and dApps can show that they are committed to protecting their users and are willing to take steps to mitigate risks. This can help to attract more users to the DeFi ecosystem and encourage the adoption of blockchain-based financial products and services.

Third, DeFi insurance can help to support the growth and development of the DeFi ecosystem by providing a source of funding for new projects and innovations. By offering insurance, DeFi protocols and dApps can generate revenue that can be used to invest in research and development, expand their operations, and improve their services. This can help to drive innovation and competition in the DeFi space, ultimately benefiting users and the broader blockchain community.

The risk of smart contracts hacks and exploits is too large to ignore. Blockchain projects are putting a lot of effort into securing their protocols and safeguarding digital assets. But sadly, current measures are inadequate. Now’s the time for digital asset owners to mitigate security risks by purchasing cover protection. Visit the Neptune Mutual marketplace today to check out the various parametric cover products for popular DeFi projects. Take out a policy and enjoy the peace of mind that comes with knowing that your digital assets are covered.