Joining Dots Between Neptune Mutual and Arbitrum

Understand the aligning of Neptune Mutual with Arbitrum for enhancing cover protection.

Youtube Video

Playing the video that you've selected below in an iframe

Discover the Neptune Mutual marketplace, its features, and multichain coverage options.

DeFi insurance plays a significant role in DeFi, where the security of users’ assets is crucial. Neptune Mutual revolves around the same space, offering cover policies to crypto users and helping them safeguard their assets against potential risks.

At its core, Neptune Mutual provides a marketplace where projects can create cover pools. The liquidity in the pools is the source of funds for users to purchase cover policies.

This unique marketplace is not just limited to allowing cover purchases; it comes with a handful of features and functionalities designed to reward users, enhance the user experience, and enable seamless claim payouts. Additionally, the marketplace supports a variety of activities such as providing liquidity, reporting incidents, and locking NPM tokens.

In this blog, we will explore the diverse aspects of the Neptune Mutual marketplace and the benefits it offers to its users.

When it comes to offering cover policies, the Neptune Mutual marketplace is available on three chains: Ethereum, Arbitrum, and BNB Smart Chain.

Initially, Neptune Mutual launched on the Ethereum blockchain to provide protection against hacks and exploits within the Ethereum network. However, due to the high gas fees on Ethereum, we expanded to Arbitrum and, subsequently, to BNB Smart Chain. This expansion helps reduce the cost of purchasing coverage policies.

Having multiple chains provides flexibility for users. They can buy policies on the network they are most comfortable with. For example, users with assets on the Arbitrum network can purchase cover policies on the same chain, ensuring convenience and efficiency.

Additionally, different chains could provide coverage for different versions of the cover product and could have varied cover parameters. This variation allows users to choose the best options for covering their assets precisely.

For example, the 1inch cover product is available in all three chains. However, it covers 1inch V3 in Arbitrum but 1inch V2 in Ethereum and BNB Smart Chain.

All in all, being available on multiple chains helps our team cater to a diverse set of users, meeting their specific needs and demands effectively.

In addition to these, the Polygon network is also available in the marketplace to facilitate bridging features.

At Neptune Mutual, projects establish their own liquidity pools that enable their communities to purchase cover policies. The pools are funded by LPs, who gain attractive yields in return.

The marketplace lets project owners create two types of cover pools: Diversified and Dedicated. Each type is tailored to meet the distinct needs of liquidity providers (LPs) and cover creators, optimizing benefits for all parties involved. Let's see them in detail.

Dedicated cover pools are created by product owners or developers specifically for a single product. These pools have parameters that address the unique security risks associated with that project. They are particularly beneficial for DeFi or Metaverse projects with established communities, as these community members are the primary beneficiaries of the cover policies.

For example, Binance and OKX are the dedicated cover pools available on the Ethereum Network.

In a dedicated cover pool, liquidity providers contribute assets exclusively to this specific pool. The funds are then used solely to cover risks related to that particular project. The returns for liquidity providers in dedicated pools come from the fees collected from cover policy purchases.

A major advantage of dedicated cover pools is the assurance of cover payouts. Since these pools are allocated to cover just one project, they maintain a liquidity level that exceeds the maximum coverage underwritten, ensuring claims can be met.

Neptune Mutual also offers diversified cover pools, which include a variety of cover products within a single portfolio. These pools are created through the collaboration of multiple teams or product owners, who collectively pool their liquidity.

For example, Popular DeFi Apps is a diversified cover pool with individual cover products like 1inch, Bancor, Compound Finance, Convex, DYDX, GMX, and SushiSwap on Arbitrum.

In a diversified cover pool, the liquidity provided by liquidity providers is spread across all the cover products in the pool, rather than being focused on a single product. Returns for liquidity providers in this setup come from the total cover fees generated by all the cover products within the pool. However, cover policies can only be purchased through specific project pools rather than directly from the diversified pool. This ensures that cover purchases are targeted and specific to individual project needs.

Diversified cover pools offer a notable advantage to liquidity providers: the potential for higher returns. Since the pool includes a range of cover products, it is unlikely that all will become claimable simultaneously, allowing for higher potential returns on the pooled funds.

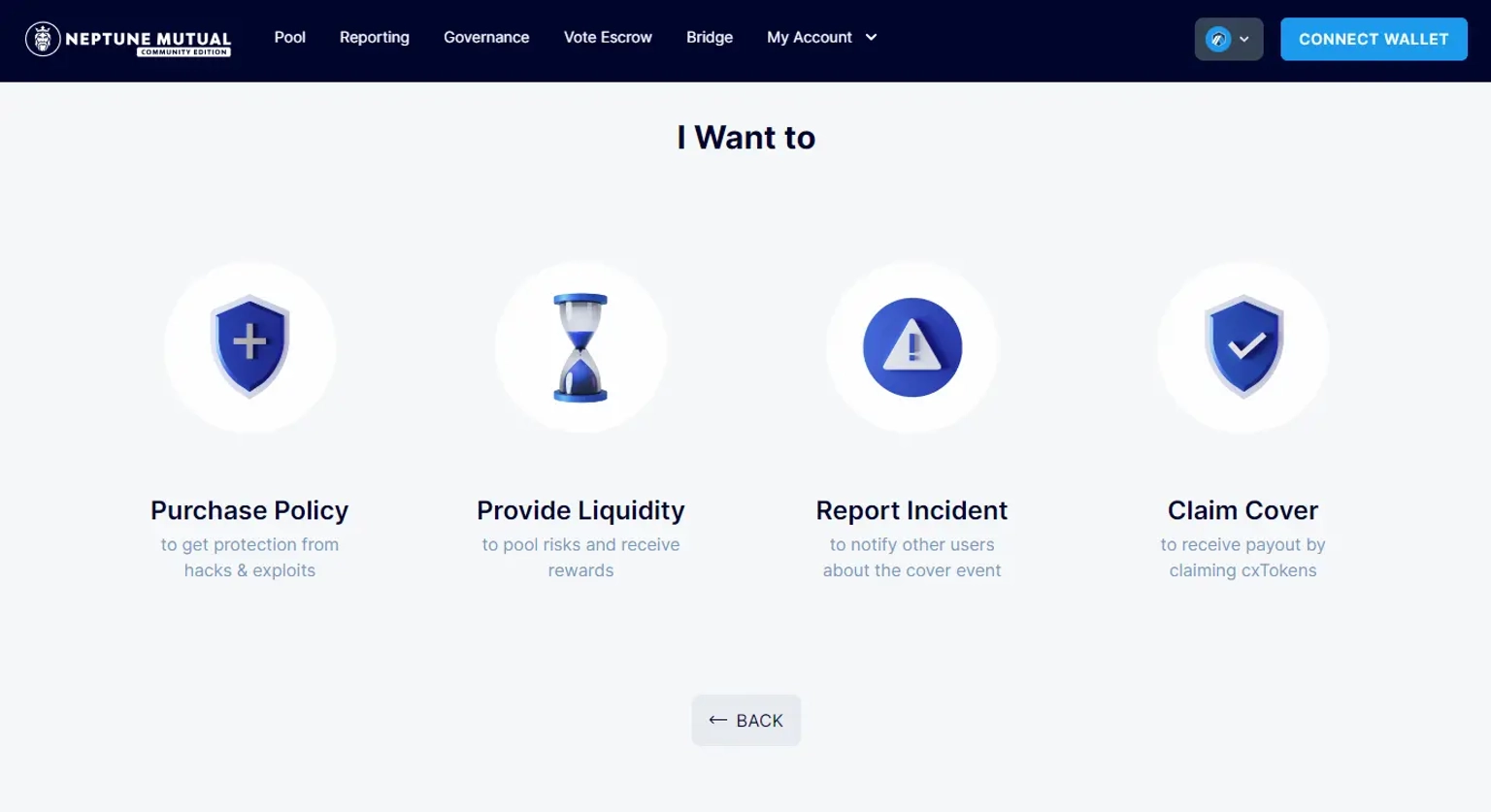

In every cover product in the three chains, users can purchase cover, provide liquidity, report incidents, and claim payouts.

Moreover, users can also carry out additional actions, like locking their NPM tokens to receive veNPM, with the vote escrow feature.

When it comes to purchasing cover, it’s the major offering of Neptune Mutual as a DeFi insurance solution.

As mentioned earlier, users can choose the network on which they want to purchase covers. Users are advised to read the cover terms and parameters before proceeding with the cover purchase.

We have a detailed blog on purchasing cover policies that you should check out.

The cover pools in the Neptune Mutual marketplace are supported by the liquidity provided by liquidity providers (LPs). This liquidity boosts the pool's capacity to offer cover policies, meaning that more liquidity results in a greater ability for the pools to sell cover policies.

If you have funds and are looking to gain returns, you can provide liquidity to Neptune Mutual's cover pools. You'll earn a percentage of the fees collected from cover purchases in the pool you’ve contributed to, enhancing your earning potential.

Here’s a blog explaining how to provide liquidity to Neptune Mutual cover pools.

Our incident payout system operates under community governance, ensuring fairness and trust in resolving incidents and payouts. Users can report and vote on incidents, like hacks or exploits, that may trigger a cover pool policy. To report an incident, users must stake a certain amount of their NPM tokens.

Participants can vote on whether an incident has occurred or vote against a report they believe is false. Incorrect voters' staked tokens are distributed proportionally to the correct voters once the incident is resolved. This process encourages participation by offering rewards to those who engage in reporting and voting.

Check out our blog explaining all about receiving rewards at Neptune Mutual.

Sometimes, dishonest reports could vote falsely and try to gain an unfair advantage from the voting system. They can either falsely report the occurrence of an incident or vote against an incident that has indeed occurred.

Check out how Neptune Mutual neutralizes such manipulative strategies and strives for fair voting and incident resolution in this blog.

Locking NPM tokens is part of the process for boosting your voting power in the NPM emission Snapshot voting.

Neptune Mutual has recently launched the vote escrow and liquidity gauge features, aiming to reward the cover pool LPs with NPM emissions. The NPM emissions are distributed to the cover pools designated by the liquidity gauge. The LPs of the cover pools who have locked their POD tokens will receive the NPM emission rewards proportionally.

The distribution of the emissions can be influenced by the votes of NPM and veNPM holders in Snapshot voting. While NPM tokens provide standard voting power, veNPM offers boosted voting power. So, NPM holders can lock their tokens to receive veNPM, which will be useful to influence NPM emissions in their favor.

The vote escrow feature is already available in the Arbitrum chain. If you are an LP in the Arbitrum network, be sure to lock your NPM tokens to receive veNPM and vote the NPM emission in your pool’s favor.

Learn more about the vote escrow and liquidity gauge features from this YouTube tutorial below:

Neptune Mutual is a multi-chain marketplace, and our marketplace users might need to move their assets from one chain to another. With that consideration, we have integrated the LayerZero bridge into our marketplace across all the available chains. This integration simplifies the process, offering seamless and secure asset transfers across these chains, enhancing user convenience and flexibility. By leveraging this bridge feature, we ensure our users experience minimal friction while navigating the multi-chain environment.