Popular DeFi Apps Launches in Neptune Mutual dApp

Popular DeFi Apps diversified cover pool launches in Neptune Mutual marketplace dApp.

Youtube Video

Playing the video that you've selected below in an iframe

We are excited to share the news that our parametric cover marketplace is now live.

We are excited to share the news that our parametric cover marketplace is now live . The first cover creator in the marketplace has created a diversified cover pool called “Prime dApps” with cover products that provide parametric cover policies for some of the most well-known decentralized Applications (dApps) in DeFi.

Gillian Wu, co-founder of Neptune Mutual said,

We are delighted to be able to announce the launch of the first cover pool in the Neptune Mutual marketplace. The Prime dApps Diversified Cover Pool will offer 7 different cover products to cover purchasers, and will offer leveraged returns to liquidity providers. We are working hard with cover creators to bring Dedicated Cover Pools to the marketplace very soon, and we expect the number of cover products to grow progressively over the coming months.

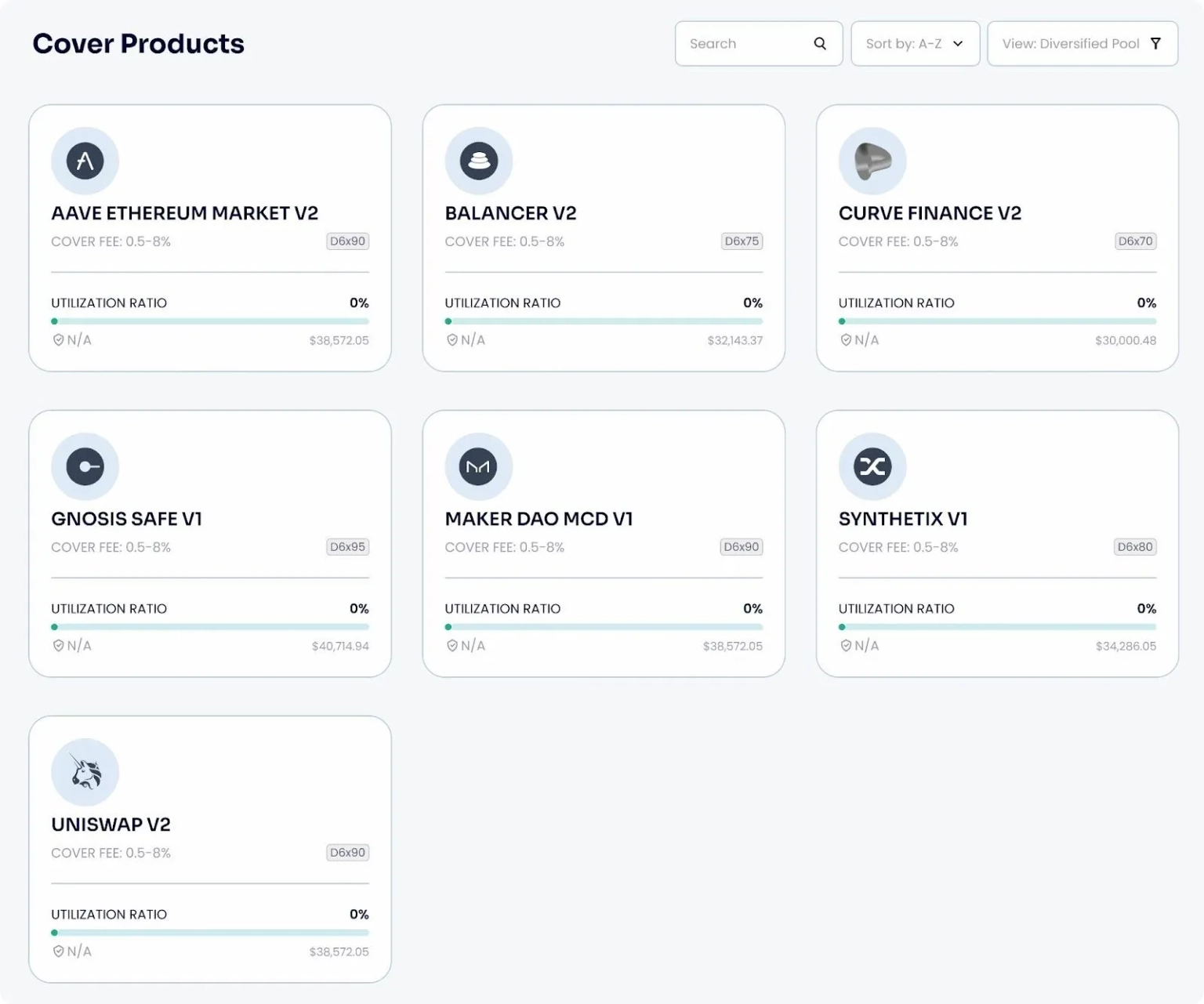

As of 11h30 am UTC on November 8th, 2022, you will be able to access cover products for: Aave, Balancer, Curve, Gnosis Safe, Uniswap, MakerDAO, and Synthetix. You will be able to review a summary of the cover products available simply by looking through the cards in the diversified cover pool:

Cover products under the diversified cover pool

Clicking on any of the cards will lead to more detailed information about each respective project and the corresponding cover policy. Aave Ethereum Market V2, for example, provides a cover policy that mitigates the loss of assets as a result of a vulnerability in smart contracts on the ethereum blockchain for Aave Ethereum market V2. One of the parameters in the policy defines a minimum loss of 5M USD, meaning that the loss to the protocol resulting from a smart contract hack needs to be at this amount to trigger this parameter. Obviously, all the cover parameters need to be reviewed carefully by cover purchasers to ensure that the policy matches their needs and expectations. In addition all users should read the full terms and conditions of the marketplace.

Cover products that have liquidity supplied by a Diversified Cover Pool are labeled with a D, followed by a number that indicates the maximum multiplier factor of the cover pool, e.g. D6 means 6x leverage at max in total for the cover pool, though in reality subject to tech team assessment, most of the individual protocols will be subject to a % limit for its constituent weight, hence the effective max multiplier (leverage) shall be smaller than the indicated number. The max percentage of liquidity allocated to a specific product is indicated by the next number, So for the AAVE card it is labeled D6X90, meaning AAVE is allowed to consume a max of 90% liquidity had there been no multiplier.

So, as an example, for the Prime dApps diversified pool with 7 cover products and 6x max leverage, a liquidity of 1M would give a Total Capacity of 6M. Selecting one cover product out of the seven, the maximum capital available for this product is 1/7 of 6M = 860k.

Applying the “weight” of 90% (D6x90) to the maximum capital available to this product would be 90% of 860K = 774K.

The cover fee amount (paid by cover policy purchasers when buying a cover policy) is calculated dynamically and will change depending on how much of the capital allocated to the particular cover product has been utilized i.e. how much of the underwriting liquidity has been committed through the sale of cover policies. As utilization of liquidity in the pool rises as a result of cover policy sales, so the cover fee of each subsequent cover policy increases. The cover card shows the spread between the lowest price, or floor price, of the cover policy, and the maximum price, or ceiling price, of the cover policy.

Users should be wary of comparing the pricing of parametric cover and discretionary cover from other protocols as the cover is very different in nature. In the case of parametric cover, if an incident is validated, ALL cover policy holders can claim a payout, without making an individual loss claim, irrespective of whether the user has suffered a loss. The parametric approach to cover protection whereby incidents are assessed, and not individual loss, is what makes parametric policy payouts both fast and reliable.

In addition to purchasing parametric cover policies, you can also supply liquidity to the Prime dApps liquidity pool. This stablecoin-backed cover pool provides the underwriting capital that enables the pool to fund the cover policies of the portfolio of cover products. In return, liquidity providers generate a yield on the liquidity provided directly from the cover policy purchaser fees.

Other apps in the DeFi, CeFi and metaverse spaces are expected to debut on the Neptune Mutual marketplace in the coming weeks.

Visit app.neptunemutual.net to access the Neptune Mutual Marketplace and engage with the various stakeholder roles. There are several video tutorials available on how to navigate and interact with the protocol.