Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

We explored what Defi insurance is, how it works, and the benefits for the digital assets.

Let’s first examine what attributes make DeFi so attractive so that we can understand why so much capital is invested in this space.

Decentralised finance, or DeFi for short, is a growing ecosystem of financial protocols and applications that are built on the Ethereum blockchain. By utilising Ethereum’s smart contract functionality, DeFi apps provide a wide range of financial services that are typically offered by traditional centralised institutions, such as banks, exchanges, and lending platforms.

One of the benefits of using DeFi apps is that they are often permissionless, meaning anyone can use them without having to go through a lengthy KYC (know your customer) process. This not only makes it easier for people to access financial services, but also opens up opportunities for those who are underserved by traditional financial institutions.

The Decentralised nature of DeFi is made possible through the use of smart contracts which are self-executing and do not require the involvement of a third party. Removing the need for intermediaries not only makes for a faster and more efficient process but also removes some significant costs that are charged by financial institutions. Transactions carried out in DeFi are transparent as data stored on the blockchain can be accessed and reviewed by anyone. DeFi also enables users to retain full control over their funds as they are stored on the Ethereum blockchain in a smart contract. The combination of these attributes explains why it is growing so rapidly in popularity not only with individual users but also mainstream financial institutions.

DeFi, however, is not immune to problems and whilst the attributes of blockchain make blockchain data inherently secure, the smart contracts which are commonly used to interact with the blockchain in decentralised applications, or dApps, can be vectors of attack for cybercriminals. Other vulnerabilities include bridges from one blockchain to another, as well as more traditional cybersecurity weaknesses including phishing links, website/application front end attacks, and social engineering scams that trick people into providing access to their accounts or wallets. Much media attention has been devoted to the theft of digital assets that have arisen from these weaknesses. Unlike traditional finance, where insurance is a precondition of business for most financial entities, in DeFi various constraints and challenges have meant that there are very low levels of adoption of insurance schemes to protect users and investors from incidents. This sets the backdrop for the need for a new approach in the field of DeFi insurance.

Broadly speaking, there are two types of digital asset in the blockchain industry:

1. Cryptocurrencies: These are digital assets that utilise cryptography to secure their transactions and to control the creation of new units. Bitcoin, Ethereum, Litecoin, and Monero are all examples of cryptocurrencies.

2. Tokens: These are digital assets that are issued on top of existing blockchain platforms. They typically have a specific purpose or use case within the platform they were created for. An example of tokens includes Neptune Mutual’s NPM ERC-20 token that will, when launched, be issued on the Ethereum blockchain.

Digital assets come in many forms, from cryptocurrencies to NFTs. They each have their own unique risks that need to be considered when selecting an insurance policy. Cryptocurrencies are susceptible to price volatility, hacking, and scams. Lending platforms can be at risk of default or fraud, and algorithmic stablecoins, as we know, run the risk of depegging from the fiat currency they are supposed to be tied to. It's important to select an insurance policy that covers the specific risks of the digital asset you're looking to insure, and it is particularly important to understand what type of insurance you are taking out so that you understand the risks of delay in terms of receiving a payout, and more particularly the risks you run of not receiving any payout whatsoever (read below the paragraph on The Problems of DeFi insurance).

Digital assets are often stored in wallets that are connected to the Internet. This makes them vulnerable to hacking and other cyber crimes. In addition, many digital assets are traded on decentralised exchanges that are also built on the Ethereum blockchain. These exchanges are often less secure than traditional centralised exchanges, making them more susceptible to hacks.

As a result, it’s important to have some form of insurance in place to protect your digital assets from loss or theft.

A traditional insurance company works by pooling together premiums from many different customers and investing this money in a variety of assets. The income generated from these investments is then used to pay out claims made by policyholders.

One problem with this model is that it is very centralised, meaning that there are a lot of middlemen involved who take a cut of the premiums and the claims. This not only makes the process expensive, but also slow and bureaucratic. In addition, the traditional insurance model focuses on individuals proving that they have suffered a loss that is covered by the policy and this doesn’t fit well with the DeFi environment in which many users are anonymous, and more particularly events can impact many thousands of people all at the same time, creating a huge and lengthy backlog of work for claims assessors. We will also review an approach called discretionary insurance which is being used by a number of entities to provide protection policies to DeFi users.

An insurance mutual is a type of organisation that is owned by its policyholders. This means that the profits generated by the mutual are distributed back to the policyholders in the form of dividends. One of the advantages of an insurance mutual is that they are typically more aligned with the interests of their policyholders than traditional insurance companies. This is because traditional insurance companies are typically owned by shareholders who are looking for a return on their investment, whereas policyholders are the sole owners of an insurance mutual. In the case of DeFi insurance mutuals it is important to understand who is bearing the underwriting risks and who shares the returns or losses in the event of claims on the underwriting capital.

Discretionary insurance is a type of insurance that pays out based on the discretion of the insurer loss assessors. This means that the insurer will decide whether or not to pay out based on their own discretion, as opposed to a legal obligation based on the insurance policy contract.

Parametric insurance is a type of insurance that pays out based on predefined parameters. This means that the payout is not at the discretion of the insurer, but is instead determined by whether the incident conforms to the parameters set out in the cover policy.

In the following blog we highlight a number of challenges facing implementation of insurance solutions in the DeFi space including:

We also cover the design principles used by Neptune Mutual in order to solve these problems and create a low risk, reliable and scalable protection solution. Read the full articles here: Understanding insurance protocol design

The challenges of DeFi insurance are not limited to cover policy holders, but also extend to liquidity providers that invest underwriting capital. Three of these less well-known problems were described in our blog about understanding underwriting capital, namely:

Problem 1: Indefinite Lock-ins

Problem 2: Open-ended risk pools

Problem 3: Loyal token holders suffer from incidents.

Again, if you are interested in learning more about becoming an LP then you might to read further about these issues: Understanding Underwriting Capital

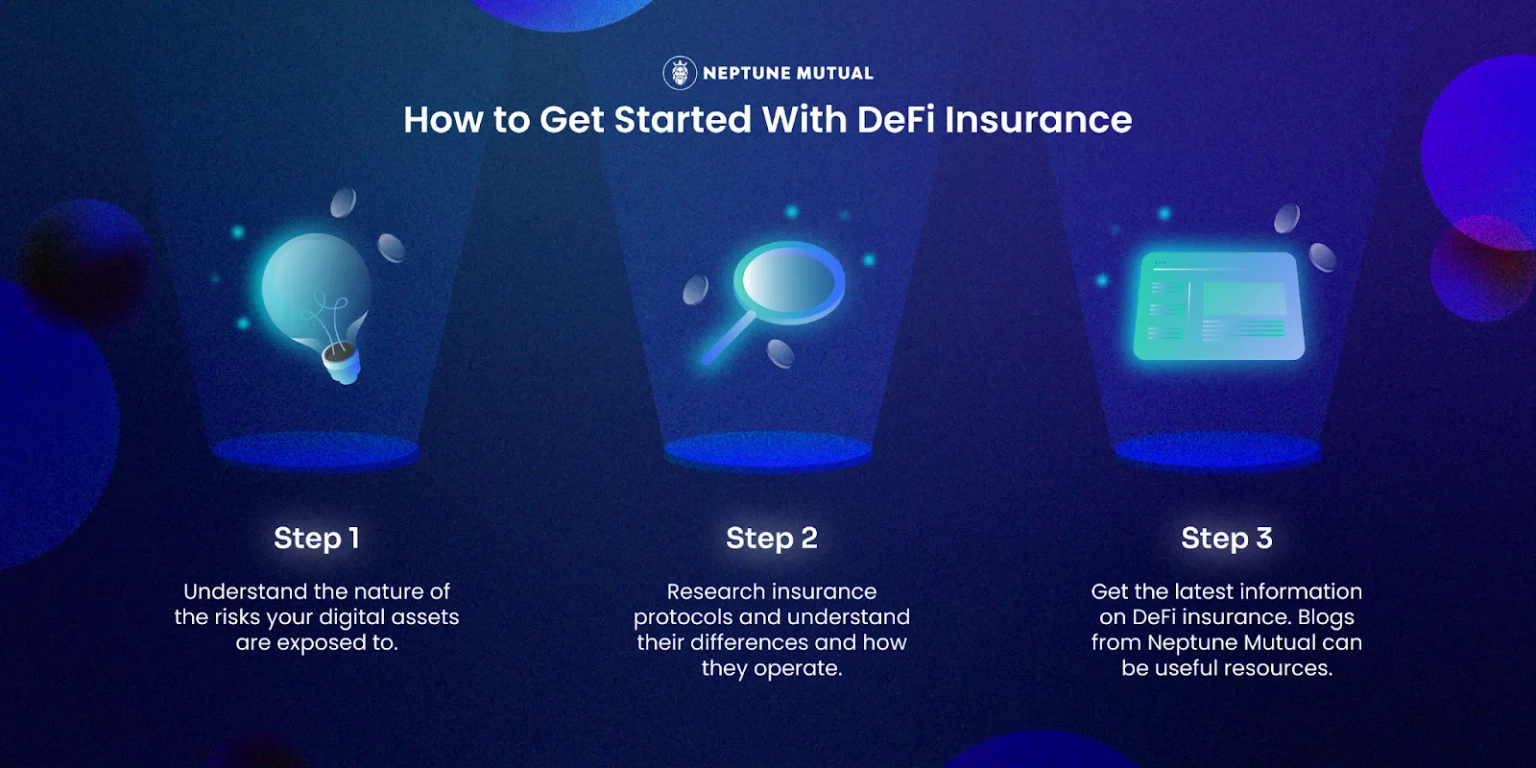

The first step in getting started with DeFi insurance is to understand the nature of the risks your digital assets are exposed to. This forms the starting point from which you can research how best to mitigate these risks. As we have seen, there are different types of insurance protocols and not only are their protection mechanisms quite different, but they also vary quite significantly in terms of the risks that they cover, so you will need to do some research about the different insurance protocols in the market. A good place to start for this is the list of insurance protocols, and the corresponding TVL (total value locked) provided by DefLlama: https://defillama.com/protocols/Insurance

The second step is to research insurance protocols and understand their differences and how they operate. At Neptune Mutual we are developing a set of resources in different media forms and channels to help the community understand the risks and solutions being proposed to mitigate these risks. Joining a community interested in security and digital asset protection may be a good starting point, and at Neptune Mutual we have active Discord, Telegram and Twitter communities.

We also have YouTube tutorials that explain how to use the Neptune Mutual parametric cover pool marketplace that is available for anyone to try out and use for free on one of the blockchain testnets.

Finally, we regularly produce and publish content to the blog section of our website. In terms of discovering DeFi insurance, you might be interested in: Parametric protection: covering the basics

As well as our recent blog on our new and important development of Diversified Cover Pools: Diversified Parametric Cover Pool

Are you worried about the safety of your digital assets?

If so, find out more about what we at Neptune Mutual have to offer with the parametric cover policies available within our marketplace that provide protection against hacks and exploits.

The dedicated cover pools offer guaranteed payouts in the event that an incident is validated as we believe users are looking for policies that they can rely on when problems arise.

Join our Twitter and Discord communities to learn more about Neptune Mutual and our parametric insurance policies.