Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

Over 18,500 users, continues testing and upgrading, and many more interesting testnet review.

Looking back, we couldn’t have anticipated such a large and active participation in the rollout of our application on the testnet. We really appreciate this input from our community.

Many thanks to everyone who joined us in trying out our protocol and for all those great comments shared on our Discord channel.

Over 18,500 users, including you, purchased cover policies and provided liquidity to cover pools on our platform. We’re impressed to see how active you were in reporting and voting on incidents as well as participating in our staking pools.

The tutorial videos we published on our YouTube channel were viewed over 5k times. We will continue to add new types of content to our channel so don’t forget to subscribe to get the latest Neptune Mutual updates.

The Neptune Mutual testnet has without a doubt exceeded our expectations. Thanks to you!

Your feedback helped us refine and improve our application as we move towards our launch on the mainnet.

Over the weeks between our testnet launch, March 10th, and the end of our Gleam competition, April 10th, our users’ feedback helped us develop and significantly improve the Neptune Mutual protocol — this underlines to us the importance and value of our active community.

Hence why we’re so excited to reward our most active testnet users — results to be announced in May. This is our way of rewarding our community for their steadfast feedback and support.

While we wait to find out who our 100+ lucky winners are…

Let’s go on a quick run-through of everything that’s happened to date on the Neptune Mutual testnet:

After receiving a much higher than expected number of testnet users, the massive spike in traffic overloaded our database servers and sent our application offline for a couple of hours.

We upgraded our database hosting plan to allow much higher traffic, and got the application back up and running.

As our database size became larger, we kept making several performance tunings and query optimizations.

We’ve been using The Graph protocol for indexing blockchain events and we faced some indexing issues that made the application sluggish when reflecting the amount of liquidity provided and policies purchased. On one occasion, the Graph protocol also suddenly went offline for a few hours.

The Graph protocol going offline was something we never bothered to think would happen. We had to come up with a solution fast to avoid these issues again arising in the future. We quickly built a subgraph bridge that caches known events to ensure that our applications remain available even when The Graph is temporarily down.

The Ropsten network has always been our preferred test network choice as it is similar to the (current) Main Ethereum Network. The primary reason to deploy our protocol on Ropsten was to check and see how our protocol functions in a multi-user and close to the real-world environment.

Interestingly, we witnessed frequent reorgs in the Ropsten network. Transactions that were included and confirmed having more than 50 confirmations disappeared from Etherscan. The Ropsten network was relatively unstable during full load than what we experienced using it earlier.

Many users commented on the performance issues they experienced using the Ropsten network. Users who purchased policies saw their cxTokens disappear after an hour. The platform’s TVL kept fluctuating up and down even when a steady flow of liquidity was added. The reorgs not only affected our application but also the hosted subgraph. As a result, users who collected points on the leaderboard also saw their points disappear frequently. Overall, the network was slow and unreliable.

Because of this, we switched to a faster and more reliable test network, Polygon Mumbai. Once we deployed our protocol in Mumbai, the user experience became relatively stable. There were no longer any reorg issues and, as a result, no more reindexing issues and transactions disappearing.

We updated our UI/UX design to enhance the Neptune Mutual experience.

In particular, we improved the transparency and labeling of the status of transactions on the protocol. To make it easier to identify if a transaction is in progress or if it has been completed successfully.

We achieved this by using unique icons for each different status of the transactions.

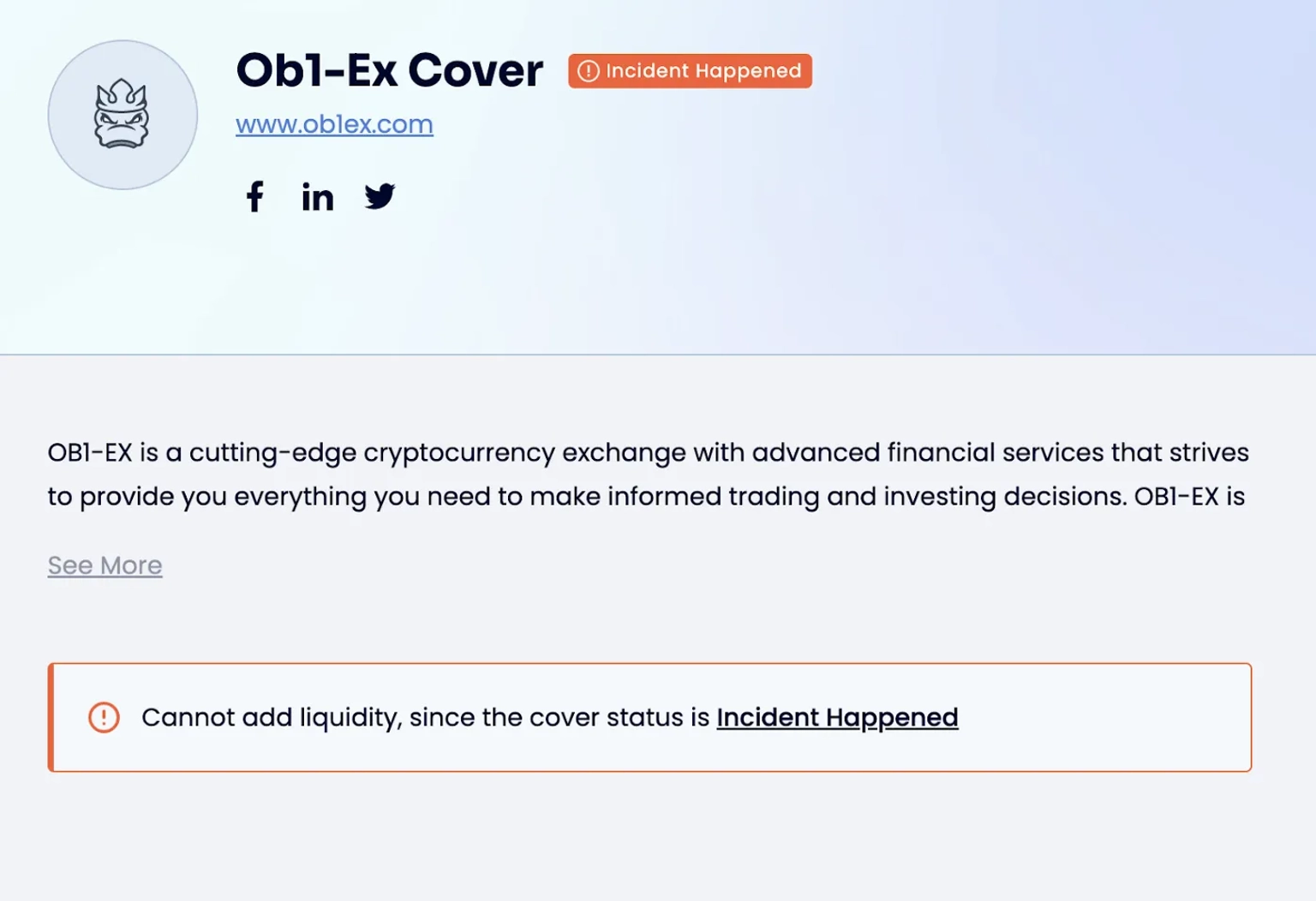

Based on user feedback, our team added an icon to display the policy status, disabled the ‘purchase cover’ and ‘provide liquidity’ features when a cover is in its reporting period, and the cover status is now shown on almost every page on the platform.

We also added an icon for the process of adding tokens to a user’s MetaMask wallet.

As a global community-driven protocol, we place huge importance on making sure users get access to the platform in their native language.

That’s why we added a multi-language support feature so that our users can access Neptune Mutual in their native language wherever they may be in the world.

Although this is still a work-in-progress, we’re proud to say we’re going all-in on this.

Our team improved validation in our forms particularly with our cover purchase, providing liquidity, and other protocol features.

We improved our platform’s transaction error handling to avoid future complications when it comes to transactions.

We believe that hiding blockchain error messages is not a good design and therefore added a function to forcefully send a possibly failing transaction. The failed transactions were helpful in debugging why such an error occurred.

Balances and allowances now display more accurately, in real-time after a user performs an action.

Strategy

Governance

Cover Lifecycle

Liquidity

Policy

Bond and Staking Pool

Flash Loan

NPM Token

POD Fungibility

Throughout the duration of the testnet we gradually unlocked some of our primary protocol features.

At launch, we showed our testnet users how to obtain testnet tokens, purchase a cover policy, and provide liquidity on the Neptune Mutual platform.

A week later, we made our incident report and claim cover payout features available for everyone to try out. During this time, our Discord channel shared pseudo testnet incidents that users could report in real-time.

Following this, we opened our staking and POD staking pools and our bond pool feature and we shared how these features work.

Our community has helped us achieve and surpass the goals that we set ourselves for our application launch on testnet.

We value the feedback our users shared with us on how we can further develop Neptune Mutual. Based on their review and suggestions, our team has been able to move forward in preparation for the mainnet. Again, thank you.

As a community-centric protocol, we also opened and grew different social media channels where we can connect with our users. An accomplishment that led us to grow our community way beyond our expectations.

Staying true to our mission, we hope that our testnet has shed light on the importance of digital asset protection. Neptune Mutual can help you get covered and be more confident in this new era of blockchain technology.

A good start indeed! But, our work is not done yet.

Also, it’s not too late to experience Neptune Mutual.

Try our testnet at test.neptunemutual.net