Collaboration between Neptune Mutual and SushiSwap

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

Youtube Video

Playing the video that you've selected below in an iframe

Learn more about the types on insurance model and which is more suitable in a blockchain.

Discretionary and parametric cover are the two models that are being adopted to provide onchain cover policies to mitigate a variety of risks in the blockchain industry. Whilst they have the same goals – risk mitigation and asset protection – they are fundamentally different in their approach.

With decentralized insurance finally making its way to the blockchain ecosystem, we look at how these cover models stack up against each other. How are they different? More importantly, which model is more suitable in an emerging blockchain environment where risks are ever present and increasingly harder to quantify?

Here’s what you need to know about discretionary and parametric models.

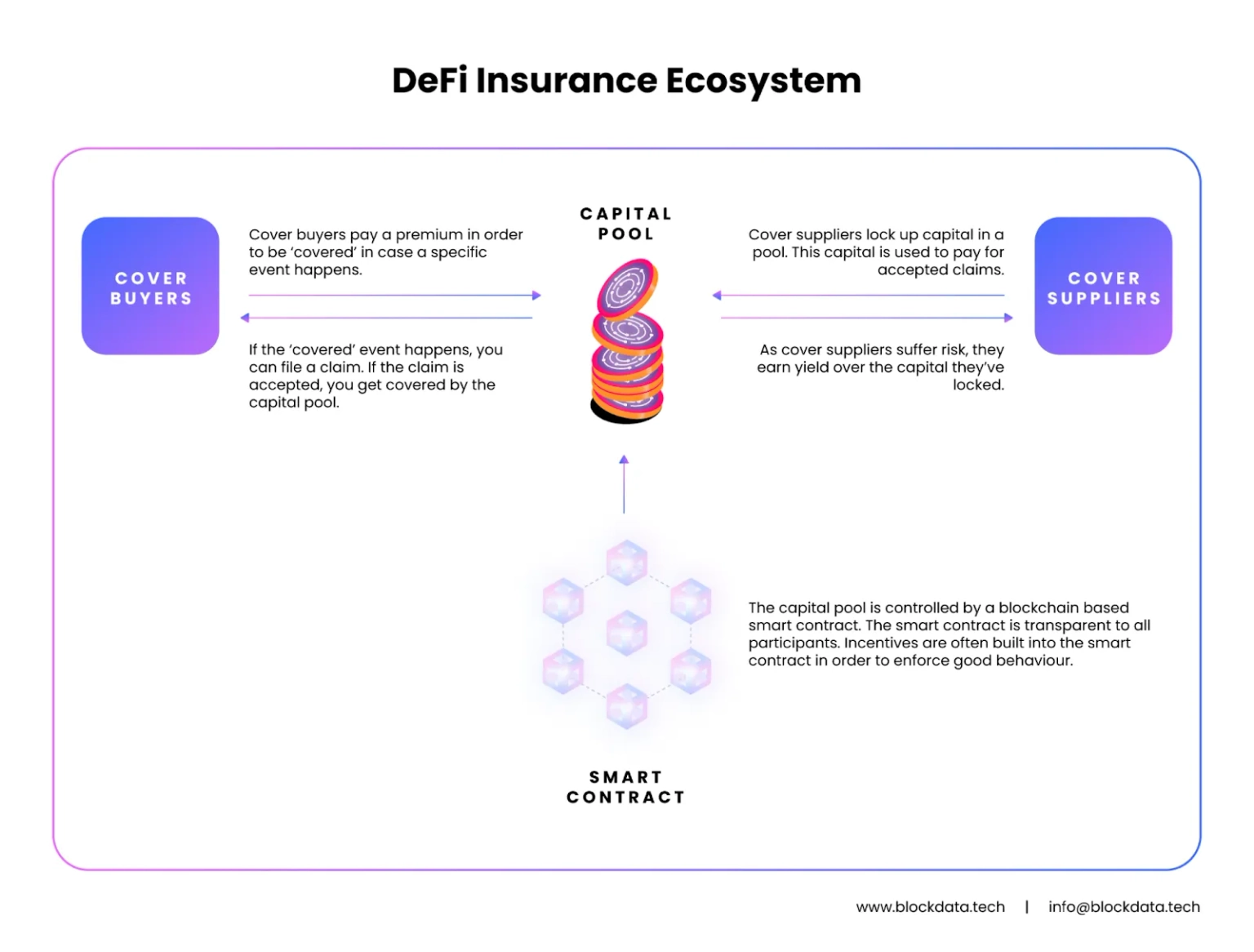

All over the world, people turn to insurance as a hedge against the risk of financial losses. The premise is quite simple – individuals and organisations pay money into a pool designed to offset losses that may result from certain risks. By paying monthly premiums into the pool, they essentially transfer their risk exposure to the insurance provider, who by virtue of the pooled funds under their administration, is better equipped to cover against possible losses.

Should a loss occur, the provider pays out to affected policyholders based on the terms of the policy agreement.

Of course, there are a number of important points involved, particularly with regard to how risks are evaluated, how losses are verified, how claims are processed, who is eligible to receive a claim, and how payouts are calculated and disbursed. As a matter of fact, these are the main differentiating factors among insurance models today. Let’s examine them now.

Let’s do a quick comparison of their key features so that you have a better idea of how these cover models differ from each other.

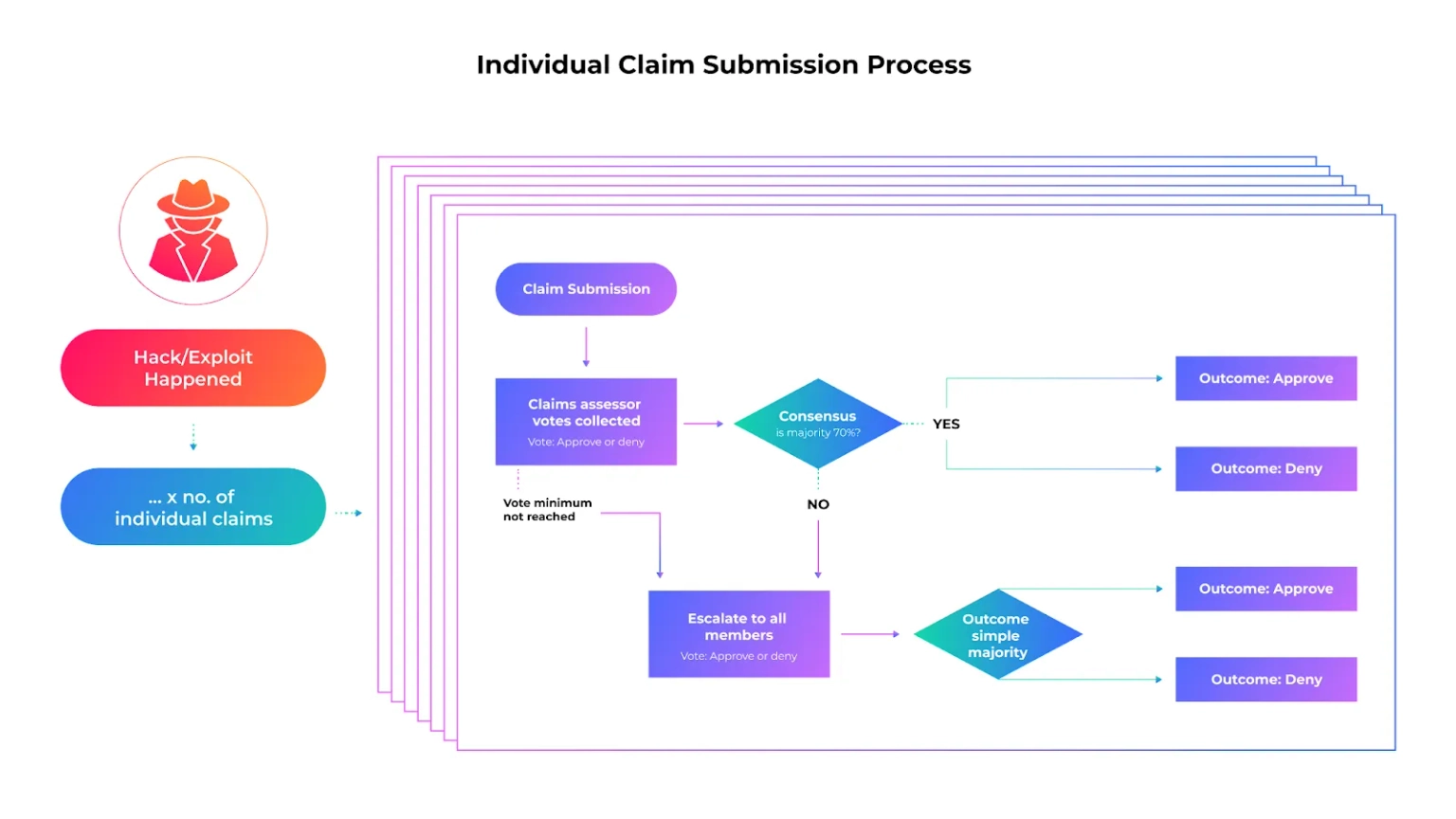

With discretionary models, assessment focuses on the specific nature of each and every individual loss, and whether the loss can be proved to conform to the scope of the policy.

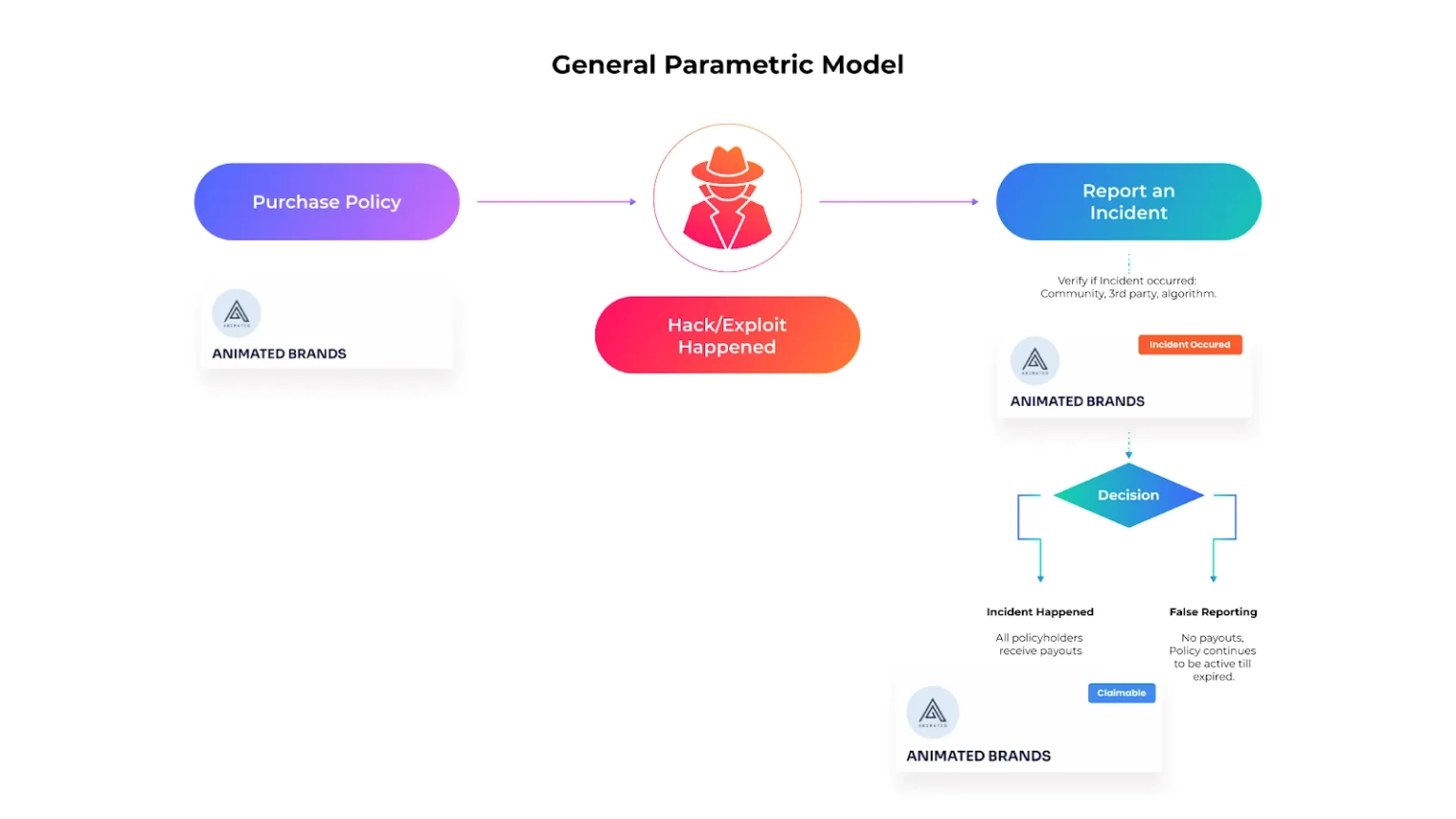

With parametric models, assessment focuses exclusively on the event itself. The parameters of the policy are generally fairly simple and binary in nature such that resolution of whether or not an event is considered to have triggered the parameters is clear.

The two different models have processes that are designed for the assessment of different circumstances. One significant advantage of the parametric model is that assessing only the event itself is obviously much faster and less resource hungry than assessing a large number of individual loss claims; this leads to faster payouts. The second principle advantage is that once an event has been confirmed by the resolution process, all policyholders can rely on this decision translating into receiving the payout that they are due.

Payouts under discretionary covers typically follow indemnity insurance principles, meaning the insurer will pay out a claim based on the value of the loss suffered by each policyholder. Simply put, people who have lost more will get higher payouts.

With parametric cover, if an event is considered to have triggered a payout, then payouts are based on the amount of cover that a policyholder has paid for, and not the actual physical damage or individual loss suffered. For this reason, the payout is completely independent of actual individual loss (note: unless there are specific terms within the policy to prevent policyholders receiving multiple payouts for the same incident - this type of parameter is designed to avoid protocols compensating users twice, once directly from investor protection fund and secondly via a dedicated cover pool policy).

Typically, with discretionary insurance cover, the policyholder initiates the claims process by submitting evidence of the damage and loss suffered.

The insurer will then review this individual loss claim and have their adjuster evaluate the value of the loss and verify, above all, whether the damage is indeed covered under the contractual terms of the policy and therefore whether it is eligible for compensation. If the claim is validated, payout for the approved loss value of the claim is awarded to the policyholder. This entire process can take weeks or months to complete.

For parametric cover, once the event has been reported then the assessment process is clearly defined, and usually a matter of days; in the case of the Neptune Mutual marketplace the incident resolution is usually set at 7 days with an additional “cooling off” day. If the resolution is made in favour of a payout, then all policyholders can make a claim and this is usually settled within 7 days.

The discretionary model is being used in the context of blockchain because of the administrative challenges of applying traditional contract insurance in an anonymous and often peer-to-peer environment.The parametric model has found widespread use in traditional insurance for risks that have little data on which to make predictions, and that are low-frequency but high-intensity when they arise, for example earthquake, flood or other types of natural disaster insurance. The attributes for which it has found favour in the traditional insurance industry make it a very promising option for use in the blockchain industry, where security risks have a similar risk profile to that of natural disasters.

A premium is the fee that you pay for cover. Many variables are considered when determining the premium amount.

Under the discretionary model, premiums are typically based on the level of risk associated with the cover policy. It is challenging for onchain insurance protocols to determine a pricing model for risk given the industry is so young and there is so little historical data on which to determine pricing models. Not only is it challenging to determine the price of risk, it is also difficult to define the scope of risks. Understanding what is, and what is not, included within the scope of discretionary cover policies is not at all straightforward, and can lead to tension between those who have been paying policy premiums and those who are underwriting risks.

Premiums under the parametric cover model are generally higher compared to discretionary cover premiums. This is because in the parametric model, all cover policy holders are compensated if an event is considered to have triggered the parameters, and the amount paid out relates to the amount of the policies that have been underwritten, not on losses incurred. In this sense parametric cover can be seen much more as a hedging instrument than an insurance product as it can be relied upon to payout if a specific event arises; the same cannot be said of discretionary cover where, frequently, policyholders claims are rejected and they do not receive a payout.

What can be said at this early stage of onchain cover protection is that discretionary and parametric cover models are quite different. It is important to understand these differences before making a judgement as to which model is better suited to mitigate the risks you are facing.

In this article we have reviewed the differences between discretionary and parametric cover primarily from the point of view of a cover policyholder, but of course there are significant differences for the liquidity providers. We explored some of these issues in detail in the blog entitled “Understanding Underwriting capital”.

We are always interested to take questions and understand the views of cover creators, policyholders and liquidity providers, particularly if you have any interesting experiences that you can share with us, if so, please get in touch.

Decentralized cover protocols are already making headway in the blockchain space, particularly among DeFi, CeFi, and Web3 projects. This is a welcome development since cover policies help provide an extra layer of protection against hacks, exploits, and scams, all of which are rampant in the industry.

Protocols that offer discretionary cover work in a similar fashion to traditional insurance in the real world – funds are pooled through policyholders premiums, which are then used by the cover provider to payout valid claims. Nevertheless, there are also distinct features of decentralised cover protocols, such as being owned by their community members, decisions being made by vote, and the bulk of the processes being managed and enforced by smart contracts.

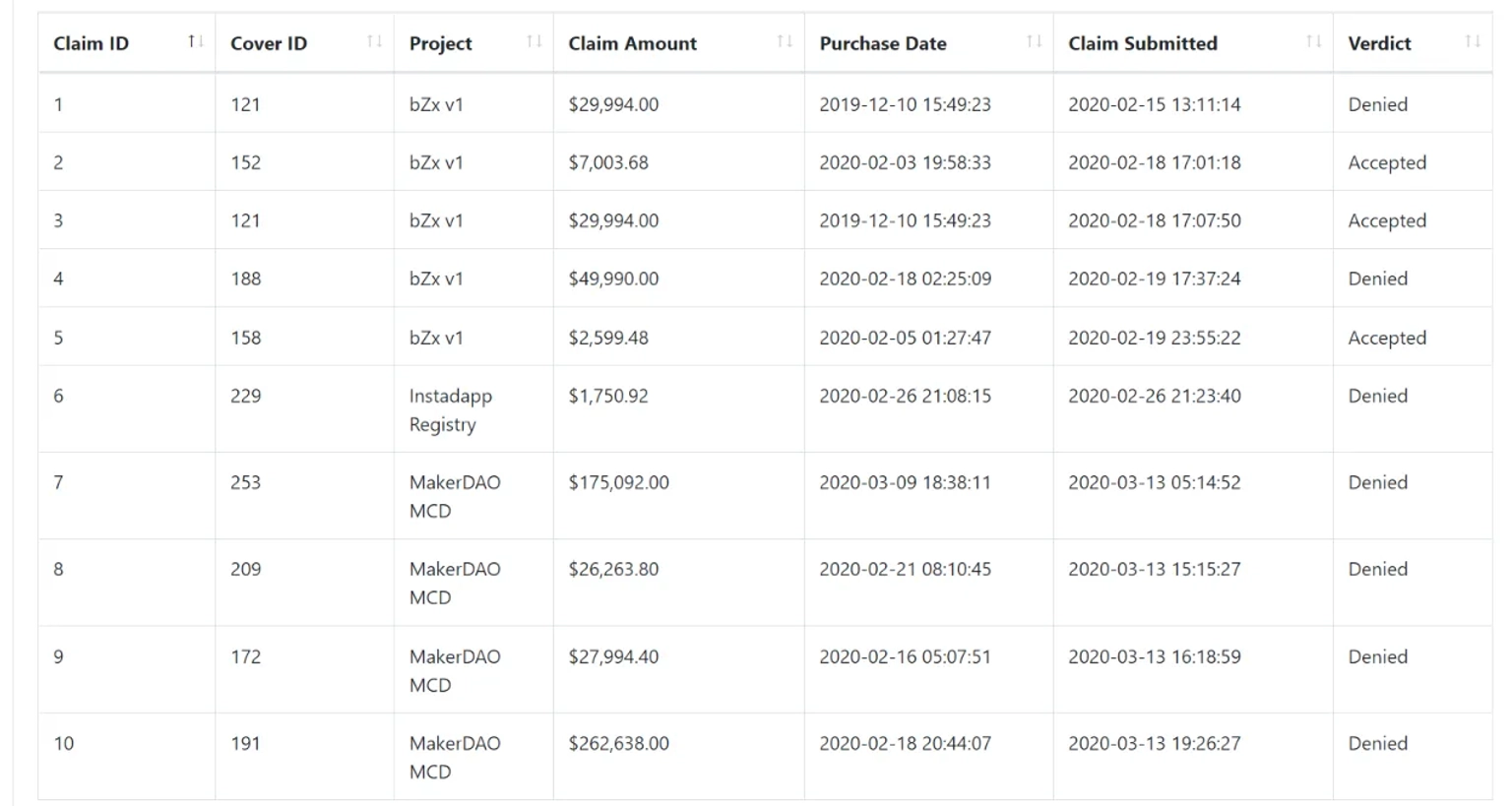

However, even in a decentralized setting, the limitations of the discretionary model are already starting to manifest themselves and may hinder its adoption. As mentioned previously, a long claim process resulting from the need to assess large numbers of individual loss claims limits the scalability and efficient execution of the discretionary model. Perhaps the most sensitive issue is the proportion of policyholder claims that are denied. Whether by ambiguity, exclusions, or complications, denied claims favour the returns of liquidity providers over the protection of policyholders, and when the proportion of denied claims becomes greater than half of all claims, this can lead to an erosion of policyholder trust. Here’s a snapshot of the Claims Tracker by Nexus Mutual, a leading Smart Contract Cover provider. Of the 10 claims listed on the image, only 3 were accepted.

However, even in a decentralized setting, the limitations of the discretionary model are already starting to manifest themselves and may hinder its adoption. As mentioned previously, a long claim process resulting from the need to assess large numbers of individual loss claims limits the scalability and efficient execution of the discretionary model. Perhaps the most sensitive issue is the proportion of policyholder claims that are denied. Whether by ambiguity, exclusions, or complications, denied claims favour the returns of liquidity providers over the protection of policyholders, and when the proportion of denied claims becomes greater than half of all claims, this can lead to an erosion of policyholder trust. Here’s a snapshot of the Claims Tracker by Nexus Mutual, a leading Smart Contract Cover provider. Of the 10 claims listed on the image, only 3 were accepted.

To address these inefficiencies, Neptune Mutual is building a robust ecosystem where CeFi, DeFi, and Web3 projects can seamlessly create parametric covers for their community members.

These members can then purchase cover policies for the amount they need to cover over a specified duration (up to a maximum of 3 months).

Underwriting capital for the policies is funded initially by the cover creators, and grown further by capital supplied by liquidity providers. In return for providing liquidity, these stakeholders earn income from protocol fees, and gain rewards through other mechanisms within the application.

Users can also participate in the Neptune Mutual’s marketplace as incident reporters – independent, reliable reporters who will verify the occurrence and scope of events that are reviewed by the community to establish whether they can be resolved as incidents that have triggered policy parameters.

Upon incident resolution, payouts are made to all policyholders that make a claim. The use of stablecoins helps ensure that cover pools are not subject to market volatility that cryptocurrencies and tokens are exposed to at any given time.

Visit the Neptune Mutual Documentation Page to learn more about our approach to parametric cover protection in the blockchain space.