Protecting Your Intellectual Property in Web3

Learn about the effective strategies to protect your intellectual properties in Web3.

Youtube Video

Playing the video that you've selected below in an iframe

Explore Neptune Mutual's ongoing collaboration with SushiSwap offering several benefits.

DeFi insurance currently covers only a tiny portion of the overall DeFi sector, leaving a significant amount of assets unprotected. At Neptune Mutual, we aim to change this landscape by striving to ensure that a larger share of DeFi funds benefit from insurance coverage. To achieve this, we actively collaborate with various DeFi protocols to extend our services to different communities and enhance user protection across the ecosystem.

One of our notable partners in this mission is SushiSwap (Sushi). Over time, we have engaged with Sushi on multiple initiatives, working together to integrate Sushi’s features to our platform for comprehensive benefits and easy experience to our users.

In this blog, we will explore the partnerships and alignments between Neptune Mutual and SushiSwap, highlighting how our collaboration is advancing decentralized insurance and user benefits within the DeFi space.

First and foremost, we offer cover pools for SushiSwap on our marketplace. Through these cover pools, users can purchase coverage to protect their Sushi funds against potential risks and provide liquidity to yield rewards. Our coverage for SushiSwap is available on both the Ethereum and Arbitrum networks, making it convenient for users to secure their assets on their preferred chain.

SushiSwap is one of the most popular decentralized exchanges in the DeFi space, facilitating a vast amount of trading activity and managing significant volumes of funds. With the amount of funds involved, SushiSwap naturally attracts attention, including that of cybercriminals seeking to exploit any possible vulnerabilities.

This is not to imply that SushiSwap is inherently insecure; it is far from it. It has robust security measures in place and a strong track record of protecting its users. However, as we’ve observed, even with some of the largest and most secure projects, the potential for cyberattacks and exploits remains a reality.

By offering cover policies for SushiSwap, we provide an additional layer of security, ensuring that users can safeguard their assets against unforeseen incidents.

The NPM token plays a crucial role in the Neptune Mutual ecosystem, serving as both a governance and utility token. It has several use cases, such as providing liquidity, purchasing covers, reporting incidents, creating cover pools, and more.

We recently launched a reward system for liquidity providers (LPs) with NPM emissions. This further enhances the usability of NPM tokens by allowing NPM holders to vote on which cover pools should receive NPM emissions. Users can also lock their NPM tokens to receive veNPM, which grants boosted voting power.

To further support our community and increase accessibility, we have chosen SushiSwap as one of the decentralized exchanges (DEXes) to list our NPM tokens.

#2 @neptunemutual

— Sushi.com (@SushiSwap) February 22, 2024

Neptune Mutual's cover marketplace allows projects to create parametric cover pools to protect their users' digital assets from security & custody risks and to generate stablecoin revenue for cover pool LPs.

Get $NPM at a discount now: https://t.co/FVP6MtrnMe pic.twitter.com/JApYSKpIKC

This strategic decision offers multiple advantages. SushiSwap, known for its cost-effective trading, provides a more affordable option for users to acquire NPM compared to other exchanges. Its extensive reach and popularity also boost the visibility of NPM, drawing more potential traders and enhancing our token’s exposure.

Another key benefit is the ease of access; trading NPM on SushiSwap allows users to purchase tokens directly from a decentralized platform, bypassing the need for central authority. This aligns perfectly with our commitment to decentralization.

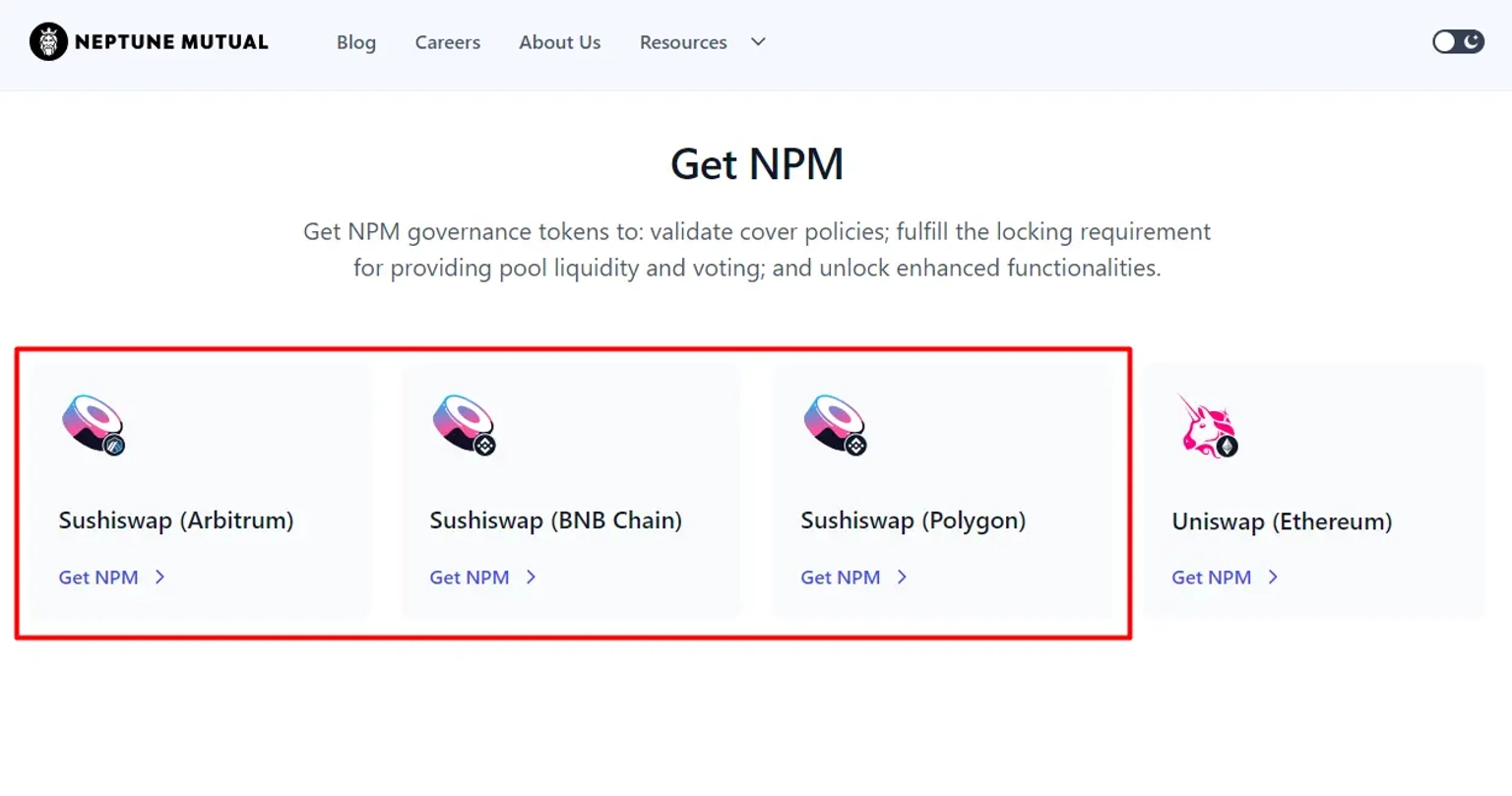

Users can now acquire NPM tokens on SushiSwap across multiple networks, including Arbitrum, BNB Chain, and Polygon. To purchase NPM, you can visit our marketplace, scroll down to the "Get NPM" section, and find the links for different networks right on our interface.

A few months ago, SushiSwap introduced a bond program aimed at creating a sustainable liquidity solution by converting bonds into Protocol-Owned Liquidity (POL). This innovative approach offers a cost-effective alternative to traditional liquidity mining, promoting long-term stability and reducing costs.

Neptune Mutual embraced this opportunity by joining the Sushi bond program. Through this initiative, users could acquire NPM tokens at a lower price than the market rate, providing a more affordable way to invest in our ecosystem. This partnership not only supports our commitment to efficient liquidity management but also enhances the accessibility and value of NPM for our community.

#2 @neptunemutual

— Sushi.com (@SushiSwap) February 22, 2024

Neptune Mutual's cover marketplace allows projects to create parametric cover pools to protect their users' digital assets from security & custody risks and to generate stablecoin revenue for cover pool LPs.

Get $NPM at a discount now: https://t.co/FVP6MtrnMe pic.twitter.com/JApYSKpIKC